Life is but a stream – The latest CTV trends and how they apply to you

Navigating the mighty streaming river

Did you know that there are more SVOD (subscription video on demand) subscriptions in the US than there are people, with 340 million over-the-top (OTT) contracts and only 330 million US citizens?

With its continuously soaring subscription rates and ever-expanding suite of must-see content, CTV (Connected TV) has also become a hot advertising platform that’s only picking up speed.

Given the sector’s rapidly growing popularity and cross-cultural buzz, when streaming giant Netflix recently announced that it lost 200,000 subscribers during the first quarter of 2022 — most people were stunned.

True, a host of reasons ranging from inflation, subscription price increases, more competition, user privacy breaches and the war in Ukraine — were all contributing factors in this massive shift. But still, despite the Netflix-induced shockwave, there is no putting the streaming genie back in the bottle.

Consumers relish the convenience, range of choice and unmatched quality that streaming adds to their TV viewing experience, and are voting with their clicking thumb, as overall growth in the streaming ecosystem continues to make waves.

98% of all US consumers subscribe to at least one OTT streaming app, states BrightBack. And according to the Convergence Research Group, 89 million streaming subscriptions were added in the US in 2021, with an additional 77 million subscriptions forecasted for this year.

In this blog, the 1st in a new series dedicated to the wonderfully dynamic realm of CTV & OTT, we’ll cover basic definitions and business models, the recent spate of merger activities, and latest trends in the industry.

Lastly, we’ll also cover the unfortunate but inevitable side effects of CTV’s soaring popularity (hint: fraud) — that end up costing advertisers millions of dollars each year.

Now, are you ready to row, row, row your boat gently down the stream?

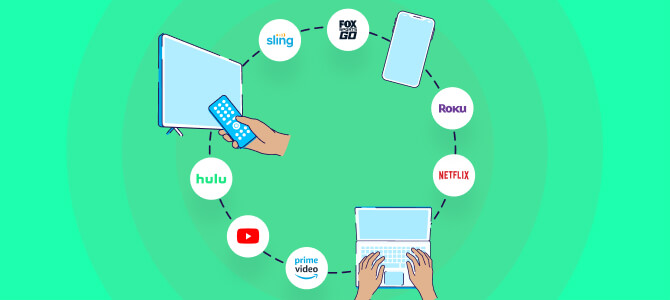

So over the top – What OTT & CTV are all about

The increasing gravitation towards OTT (aka streaming services) & CTV content simultaneously frees us from cables and broadcast schedules, and fundamentally changes the way video is sold, produced, advertised and consumed.

It’s time to dive head-first into the key players in this action-packed ecosystem, but just before we do — let’s get two fundamental definitions out of the way:

OTT (Over-the-Top)

An OTT provider is a streaming service connected to the internet, enabling video viewing on TV, desktop, mobile, and tablet via dedicated OTT apps or sites, bypassing cable, broadcast, and satellite platforms.

Connected TV (CTV)

The medium for viewing streaming content, CTV devices include smart TVs, sticks, and streaming boxes that allow viewers to enjoy OTT and streaming services via internet connectivity.

Introducing the key monetization strategies

For the end-user, the CTV experience is fairly seamless and straightforward, which is completely intentional. But, behind the screen, there’s a wide range of business models that control our access to content.

Let’s explore four of these models:

1 – SVOD (subscription video on demand)

SVOD allows users to consume as much content as they desire at a flat monthly rate. Major services include Netflix, Amazon Prime Video, Apple TV+, Hulu, HBO Max, Disney+, and Sky.

Given the fact there are no long-term contracts, the SVOD model allows far greater freedom to opt out. On the one hand, it offers users with much more flexibility, but on the other — it brings SVOD providers to be continually challenged by churn.

Still, the SVOD market is expected to grow 52% by 2025, as per Statista.

And although churn poses a major challenge for providers, it’s hardly a bad thing for consumers, as it pushes providers to keep offering high-quality and exclusive content, while maintaining aggressive pricing offerings.

2 – TVOD (transactional video on demand)

TVOD is the opposite of subscription video, where consumers purchase content on a pay-per-view basis. Major TVOD services include Apple’s iTunes, Sky Box Office, and Amazon’s video store.

This model includes two sub-categories:

- Electronic sell-through (EST) – where you pay once to gain permanent access to a piece of content.

- Download to rent (DTR) – where you pay a smaller fee to gain access to a piece of content for a limited time.

Generally speaking, TVOD services tend to offer more recent releases, timely access to new content, higher revenues offered to rights holders, and typically also attractive price incentives to encourage retention.

3 – AVOD (advertising-based video on demand)

Unlike SVOD and TVOD services, AVOD is a freemium or discounted service. That said, much like broadcast TV — consumers need to sit through ads. Major AVOD services include DailyMotion, Pluto TV, Tubi, YouTube, and 4OD, where ad revenue is used to offset production and hosting costs.

AVOD is becoming more popular with major players such as Disney and Netflix, who are expected to release AVOD services by the end of the year. And interestingly enough, YouTube has recently started to move its subscription-based premium content to an ad-based model, so far with little success.

4 – Mix & match – The multiple business models

In practice, most major streaming services / OTT providers offer or will soon offer a hybrid business model. In the case of Amazon, audiences pay a fixed monthly fee to access a library of content, while brand new releases or specific sporting events call for an additional fee.

According to Statista, the revenue share in the OTT market is split as follows:

- 51.58% comes from advertising video on demand (AVOD)

- 40.16% comes from subscription for video on demand (SVOD)

- 5.1% comes from pay-per-view or transactional video on demand (TVOD)

- 3.16% comes from video downloads (EST)

Evidently, the market is booming. And although the streaming ecosystem consists primarily of the above 4 pillars, the rising popularity of OTT content coupled with ever-evolving consumption habits — are likely to give rise to new business models that will be introduced to the market in the years to come.

Mergers and acquisitions – And why the streaming industry is slated to see more of these in 2022

As the ecosystem emerges from the pandemic, the OTT & CTV industry is on the verge of a noteworthy wave of M&A activities — driven by the players’ need to scale and expand their suite of exclusive content.

According to Ampere’s research, this trend will include two currents: the first wave will focus on intellectual property content acquisition, and the second will push the industry towards the return of large-scale mergers.

The past few years have been sizzling with such mega-size activities. Disney acquiring 21st Century Fox and Hulu, CBS’s merger with Viacom that bought Pluto TV, Amazon’s acquisition of MGM, and WarnerMedia incorporating HBO and later on Discovery. And the experts tend to agree that this speeding M&A train puts pressure on other major media companies to also consider a merger with once-sworn rivals.

The industry leaders of the not-so-distant past are now likely to decide they’re too small to compete against Disney, Amazon, and Apple in the streaming wars — unless they join forces.

And so, the industry landscape continues to consolidate into gigantic players that are seeking to capitalize on this scorching hot market, forecasted to grow to $1.039 trillion in worth by 2027, according to Allied Market Research.

Streaming wars = data wars

While cable companies are able to track TV viewership data in terms of number of views and viewer location, the insights pretty much end there.

OTT platforms, on the other hand, are able to gather significantly more granular data — not only about what people are watching, but also how they’re watching it, when and why they switch off at certain points, as well as cross-regional viewing trends.

These insights allow streaming platforms to curate data-powered content strategies that are likely to resonate well with their viewers. And as many of them now become acquired by media giants, this invaluable data can be shared within merged companies to hone their audience segmentation and amplify their cross-platform advertising efforts.

Smart segmentation backed up by viewer data enables OTT platforms to maximize their advertising budgets — by personalizing their campaigns towards avid viewers, inconsistent viewers, or MIA viewers who are at risk of jumping ship.

How do you make the most of your data in a user privacy-centric world to be able to stay ahead of the curve? Stay tuned for our upcoming guide on this very topic!

Pushing things to the ex(stream) – The latest OTT trends you need to know about

OTT video advertising is set to juggle jaw-dropping revenues of $119 billion by 2023, which is 51% of all OTT revenues, according to Statista.

As to growth opportunities, The LA Times anticipates that OTT providers are likely to start selling programs to cable and broadcast channels, rather than keeping them behind a subscription paywall indefinitely.

And while some industry experts believe subscription prices will continue to rise, streaming services are actively looking to adopt alternative revenue sources to ensure growth and gain a much-needed competitive edge.

With cost being reported as the top reason for viewers to cancel their streaming service, about 60% of US viewers surveyed by Deloitte said they would prefer an ad-supported streaming option if it would allow it to remain free of charge.

With numerous options available at their fingertips, today’s viewers are a savvier audience, highly aware of the fact they can opt out of their streaming service with a few clicks, making churn the #1 nightmare of all streaming providers.

Younger consumers are much more apt to quickly cancel their subscription as soon as their favorite show no longer airs, and then just as quickly join a rival service. According to Deloitte, the average churn rate in the US stands at 37% and reaches 50% when Gen Z’ers and millennials are concerned.

And while battling vicious attrition, OTTs are also in various stages of adding more pieces of entertainment to their subscription suites.

Tiktok, for example, is currently testing in-app gaming options, while Netflix has also joined the mobile gaming party, acquiring no less than three gaming studios as part of the company’s efforts to strengthen and broaden its customer base.

One reason for this trend is attracting younger demographics and expanding audiences, and another could be the fact that churn rates on game subscriptions tend to be lower than video. Either way, it appears to be a smart and very timely investment.

While streaming platforms scramble to position themselves top of mind for consumers who are literally drowning in streaming options, it appears that the next step for the streaming players would be to expand their offering beyond video content.

Houston, we have a problem.. And it’s called data governance

There’s no doubt that when a new market explodes, it opens up considerable opportunities on multiple fronts.

At the same time, advertisers are faced with a challenge when it comes to reaching new audiences on CTV. The ultimate goal is to serve the right content to the right viewer at the right time, which is not an easy task in the age of user privacy.

The limited access to user-level data combined with frequent data breaches, could have a detrimental effect on the industry if not handled with care.

CTV fragmentation – And how it relates to your users’ safety

The CTV industry is extremely fragmented. Viewers consume content through their smart TVs, smartphones, and game consoles, with each of these mediums having its own method of collecting user data.

At the end of the day, no marketer wants to waste their precious UA budget by bombarding users with irrelevant ad content.

So, how can advertisers deliver a better and more efficient advertising experience to users in such a fragmented landscape?

For starters, smart segmentation and measurement by a trusted MMP can go a long way.

Fraudsters’ paradise

CTV has experienced an explosion of popularity during the pandemic, which has led to an influx of advertiser attention and dollars. And wherever the money goes, the fraudsters are quick to follow.

A slew of CTV advertising scams in recent years — such as the likes of DiCaprio, Monarch, and SmokeScreen — are just the tip of the CTV fraud iceberg, robbing advertisers of huge sums of advertising revenue.

In fact, 18% of CTV ads in unprotected programmatic inventory were found to be fraudulent in Q4 of 2021, according to NewsWire.

CTV scams often exploit loopholes in how CTV ads are served, known as server-side ad insertion (SSAI). SSAI loads ads in bulk to prevent viewing experience disruptions, but because of how these unprotected inventories are built, scammers can easily hide in plain sight — defrauding advertisers by emulating views or spoofing valid premium media.

The result: Millions of dollars in lost advertising spend and completely skewed viewership measurement.

To meet these threats head on, advertisers have to partner with a solid MMP that can flag fraudulent activity in real-time, allow them to make smart decisions based on accurate data, and protect their users’ privacy.

It’s all a numbers game – How marketers personalize, measure and optimize their OTT & CTV ad campaigns

Traditional TV technology has come a long way since the days where Nielsen was the single source of rating data, and gone are the days of guessing who’s watching content or launching spray and pray commercials.

Nowadays, there are literally hundreds of streaming services that cater to individual niches, like episode content, short form content such as news reports or how-to tutorials, live streaming, and VOD.

And as viewers of all ages turn to OTT services, marketers are discovering new opportunities to engage their key audiences and promote content more effectively.

As opposed to other forms of advertisement, CTV ads tend to garner much higher viewing completion. They can reach specific audiences with strategic messages across top tier networks and popular content, and even allow advertisers to re-engage their OTT & CTV viewers across their devices.

In addition to signups, installs, sessions, ad views, subscriptions, and device type, here are four metrics you should measure when running CTV campaigns:

1 – Brand reach

With today’s fragmented video consumption landscape, reaching the right audiences at scale is key to ensuring brand growth, and keeping track of your brand reach will help you understand whether your OTT ad campaigns are indeed reaching relevant audiences.

So be sure to measure the reach, frequency, and gross rating points (GRPs) of your OTT ad campaigns.

2 – Brand lift

OTT ads are a great way to drive brand awareness across audiences, and help you answer questions like: Did my campaign change the perception of my brand? Did it drive brand awareness, favorability, or purchase intent?

Armed with these insights, you can better understand how your campaign messaging helped with awareness, association, and purchase intent for your audience.

3 – Offline lift

Customers shop everywhere, and if you have a brick-and-mortar store in addition to your mobile presence, it’s crucial to be able to connect the dots and gauge how your campaigns are driving offline lift.

This will allow you to answer questions like: How did my campaign impact visits to my physical stores? Or, how many of those visits took place as a direct result of my OTT campaign?

4 – Online visits

If, for example, you sell on Amazon, you need to understand how your advertising efforts are driving engagement and shopping intent. Use page views and page view rates as a way to measure this, and be sure to compare product detail page views before and after your Amazon Streaming TV ad campaigns.

Key takeaways

- With the rise of cord cutting behavior, CTV has already surpassed mobile in terms of total video ad impressions served.

- CTV & OTT are the future of big screen advertising, marrying the reach and impact of TV with the transparency of digital marketing and measurement.

- Overall, CTV measurement is still extremely fragmented, not unlike the mobile attribution wild west more than a decade ago. That said, the exponential growth rate of CTV will inevitably lend itself to technical innovation sooner than expected.

- Cross-device measurement is made possible under the umbrella of MMPs, and will likely become even more unified in the near future. But don’t wait. The natural synergy between OTT and mobile apps already offers marketers priceless opportunities to start testing OTT campaigns today.

- Advertisers need to embrace this change. And the first step is to ensure they partner with trusted solutions that can help them navigate these rough waters with confidence and scale.