As the digital ecosystem continues to expand and evolve, SaaS technology has become a mission-critical component for effective marketing operations.

Marketing and advertising technology falls into numerous complex and overlapping categories, with literally thousands of partners competing for your marketing dollars.

Whether you’re building your marketing tech stack from a mobile-first or web-first perspective, it can be daunting to know where to start as well as when and how to expand. And while adding or changing marketing technology requires significant investment in terms of vetting, training, development, and other resources, adaptability is key to success.

According to Ascend2’s March 2019 survey, 67% of marketers are adding new types of MarTech to the stack on a quarterly or monthly basis.

The reasons for building a marketing tech stack are varied but clear:

- From campaign orchestration to automation, measurement and data enrichment, marketing technology has the ability to significantly increase efficiency, visibility, flexibility, and value across marketing operations.

- While some services can be built in-house, doing so requires significant resources and in some cases, it may be impossible or unscalable to effectively replicate certain products (e.g. mobile attribution).

- Marketing technology is extremely competitive, with multiple providers offering similar services in each category. While there are clear leaders who carry up to ~80% market share in a given category, there is also a constant influx of new players. This drives rapid innovation and price competition, which means the partner evaluation process is never truly put to rest.

Although there is no standard formula for success, the purpose of this guide is to provide a framework for how to build a solid marketing tech stack—focusing specifically on mobile as the core platform.

We will examine the following topics throughout the course of this guide:

- MarTech Stack Foundations: establishing strategic goals and defining key stack solutions to consider across your product life cycle

- Category Deep Dives: product analytics, marketing automation, mobile attribution, and customer data platforms (CDPs)

- Advanced Considerations: evaluation criteria, getting internal buy-in, setting timeline expectations, and structural tradeoffs supported by industry trends (e.g. stack design frameworks, cost/benefit analysis, building vs. buying technology, opting for best-in-breed vs. all-in-one tools, etc.)

Mobile marketing tech stack foundations

Why do you need a marketing tech stack?

Most modern marketers don’t dispute the need for a tech stack, but for those that do, or who don’t know what a tech stack is, let’s start by defining the term.

A marketing technology stack is a collection of technologies marketers use to conduct and optimize their marketing activities.

These “MarTech” tools support, simplify, and unify the collection, organization, and utilization of user activity data across paid and owned channels.

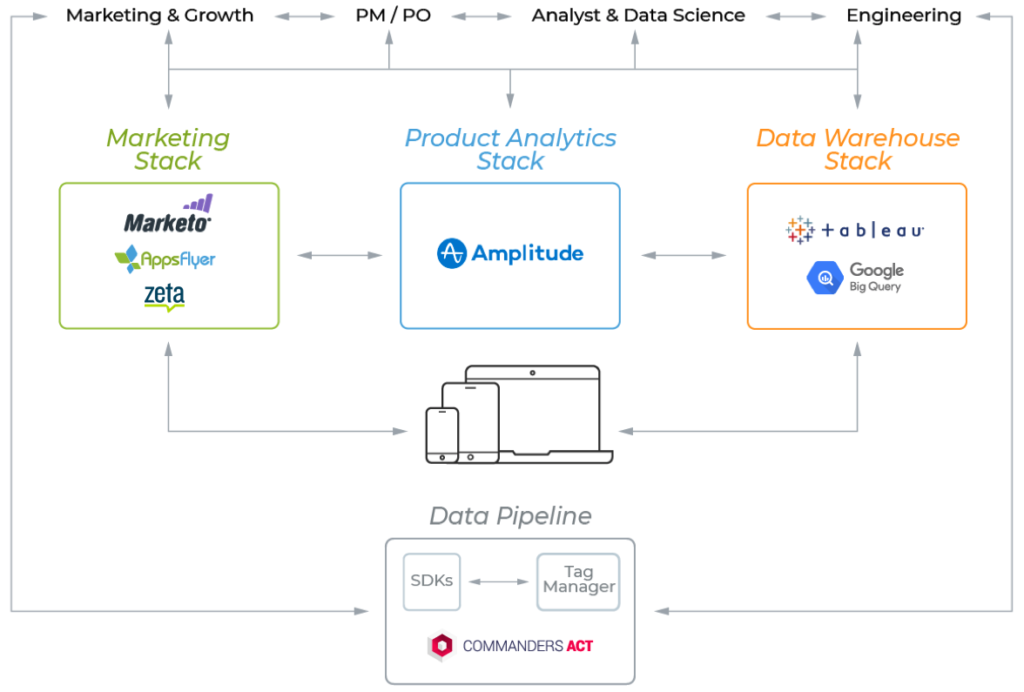

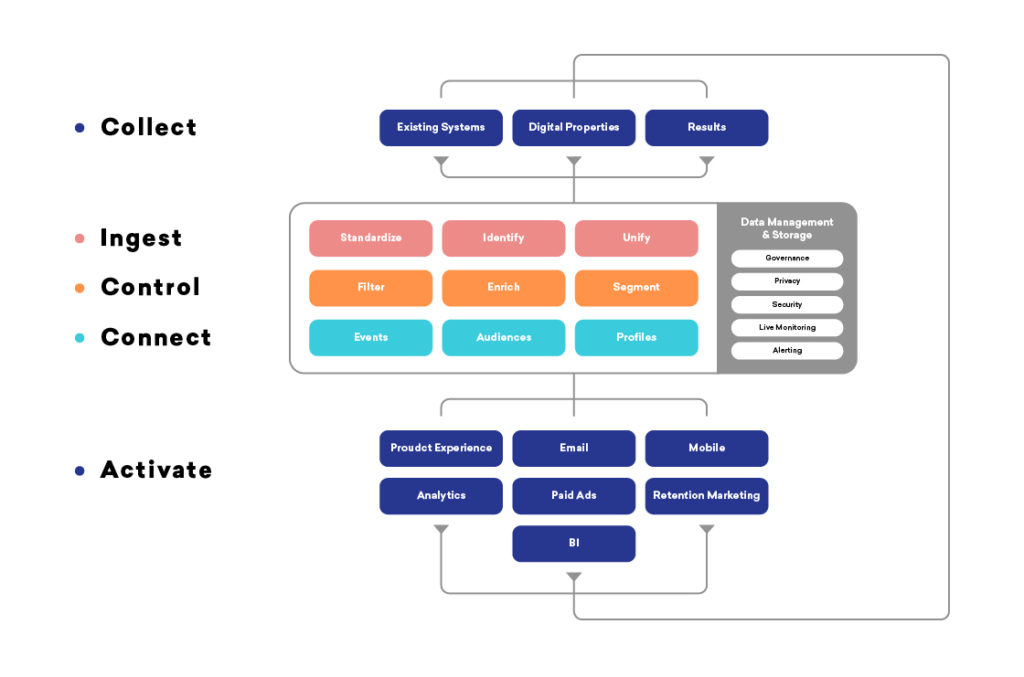

Here’s an example of a well-rounded tech stack, courtesy of Amplitude:

There are varying opinions on the necessity of each stack solution, and whether it is more prudent to build certain solutions internally, choose a free technology service or pay for more advanced solutions.

Regardless of the path you choose, the main benefits of MarTech generally boil down to efficiency, efficacy, and scalability.

Some examples of how these benefits play out include:

- Integrating disparate systems (e.g. data storage, partner integrations, data enrichment for cross-channel analytics, building audiences, postbacks, etc.)

- Activation and campaign orchestration (e.g. audience and messaging segmentation, link/creative deployment, A/B testing, email, push, etc.)

- Advanced insights to improve decision making and ROI (e.g. data visualization, cohort analysis, mobile attribution, etc.)

- User flow optimization (e.g. A/B testing, deep linking, web-to-app banners, etc.)

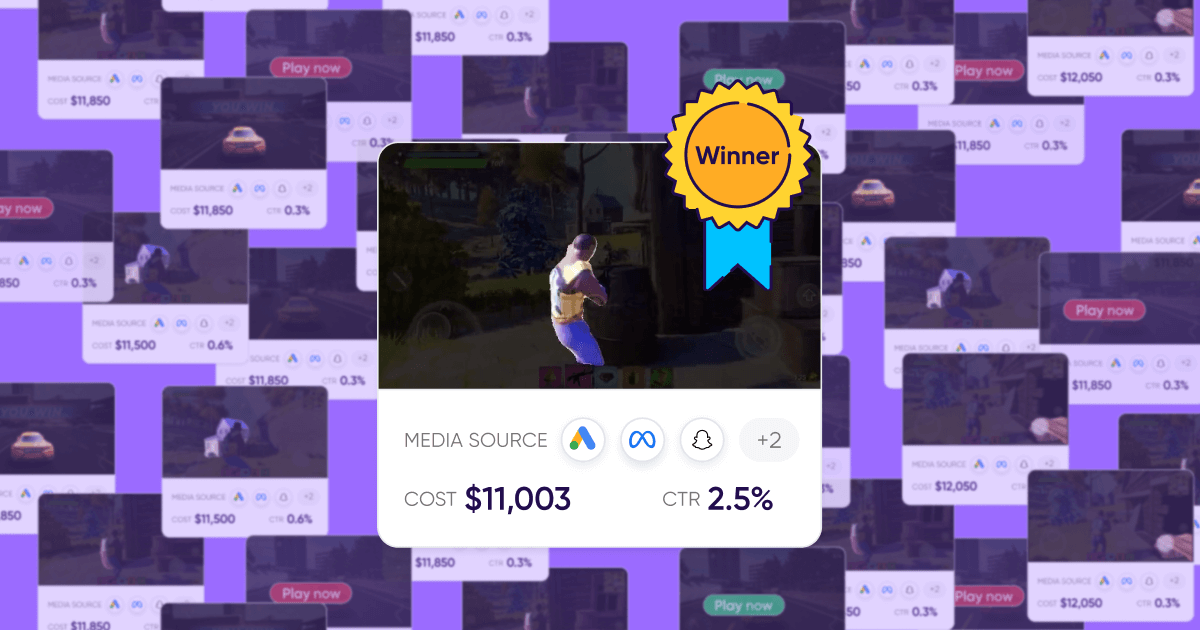

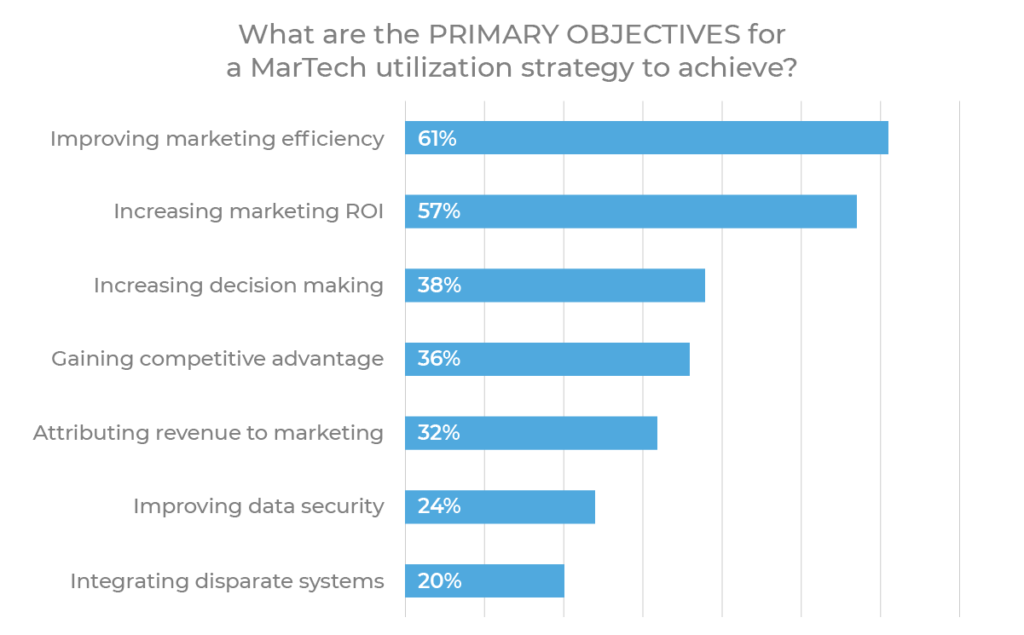

Indeed, these benefits are clearly reflected in Ascend2’s March 2019 survey, which ranked efficiency as the #1 objective for marketing tech utilization:

The same survey also found that 63% of marketers plan to moderately increase their total MarTech budget and 24% plan to significantly increase their MarTech budget.

This speaks volumes to the value of MarTech. In many cases, the benefits of paying for more advanced solutions outweigh the costs.

Foundations: How to start building a mobile MarTech stack

Whether you’re building your mobile marketing tech stack from the ground up or extending your web-first stack to accommodate a new mobile app, the first step to building your tech stack is goal mapping.

Consider questions such as:

- What are your growth goals (to inform data volume and scalability needs)?

- What does your customer journey look like?

- What are the primary KPIs for each step of the journey?

- What additional events would be helpful to measure in order to measure and optimize the full customer journey?

- What channels and functionalities will you need to acquire and retain users?

- What media partners are you working with (or plan to work with)?

- What infrastructure will you need to store and manage data?

- Who owns your data, and what security protocols should you consider to ensure your data is safe?

- How will you visualize marketing and product performance?

- Is it necessary for you to have a full-funnel view of marketing/product activity across channels and platforms?

These questions will allow you to not only categorize “must-have” vs. “nice-to-have” tools, but they’ll also guide your partner evaluation process as you compare factors such as feature capabilities, cost, partner integrations, support and scalability.

Although the first tools you adopt may be contingent on budget, you will be better off in the long run if you design your tech stack for scalability.

As you go through the exercise of goal mapping, prioritization, and budgeting, you should also think about future implications to help you build the case for new tools and guide your strategy for MarTech testing and expansion.

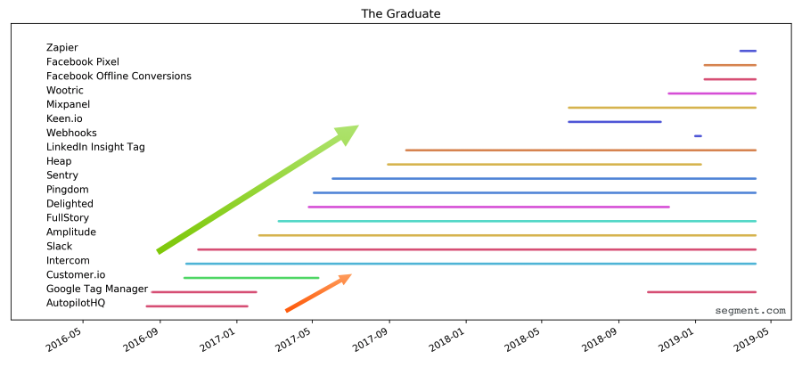

Customer data platform Segment recently released a data study that illustrates various ways this strategy can play out.

For example, some “companies have a steady ‘graduation’ across tools – they start with a handful of use cases, and steadily shift those out over time […] These users add a few tools every month. As they discover new parts of their business to unlock, and new best-in-breed tools, they migrate their business to use the cutting edge.”

The following graphic illustrates an example of this strategy, in which similar colors correspond to similar categories of tools.

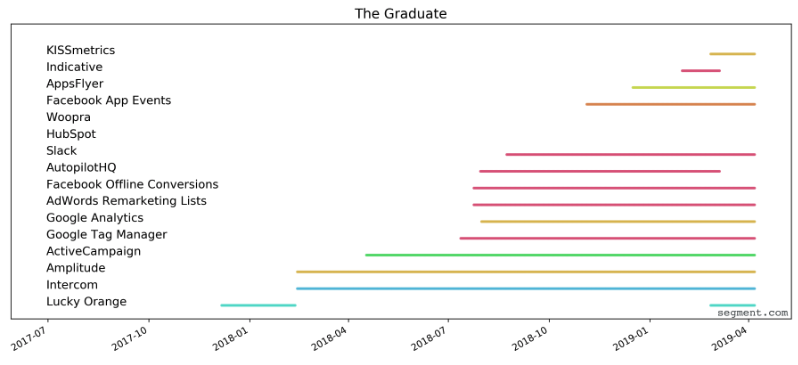

Here’s another example of a graduate who steadily expanded their tools across analytics, messaging, advertising and attribution over a 1.5 year period:

While this approach may be useful for early-stage companies who are gradually building the funds and knowledge to add new tools over time, it requires thoughtful planning to avoid resulting in a “franken-stack”—meaning a convoluted assortment of tools that are haphazardly connected into a stack.

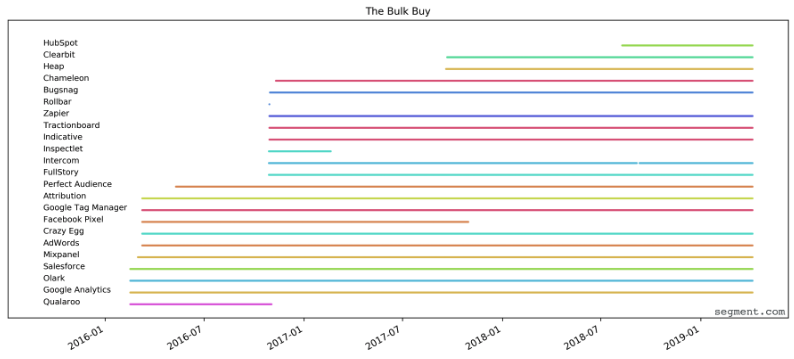

Taking a more serious upfront approach usually results in more clean, clear and unified tool collections.

Segment provides a more organized example of an upfront approach called “The Bulk Buy” in which companies “make big stack decisions in bulk.

Users don’t just enable tools one at a time. They often enable new destinations in groups of 3 to 5.”

Which strategy makes the most sense for your company?

As you start to evaluate partners within each solution category, think about the trade-offs in terms of opportunity costs as well as financial costs—and from there, what impact your strategy will have on your ability to effectively manage and scale your marketing operations over time.

Some trade-offs to consider include:

- Starting with free/basic vs. paid/advanced solutions

- Buying vs. building your own solution

- Legacy “all-in-one” tools vs. modern “best-in-breed” architecture

We’ll dive deeper into each of these topics in later chapters—but first, let’s start by defining the core components of a mobile marketing technology stack.

Fundamentals: Mobile MarTech hierarchy of needs

As an attribution company, it goes without saying that we believe attribution is core to running effective marketing.

Although attribution might not be the first thing you think about as you build and launch your first app on a budget, the reality is attribution and deep linking tools are mission-critical to any marketing team that seeks to build a world-class growth and user acquisition function.

Growth is the name of the game among high-velocity startups and even Fortune 500 companies that are now expanding their digital footprint – and ultimately, growth starts and ends with being able to attribute and measure the sources of your traffic across web and mobile.

Still, there are many factors which can feed into the decision-making process and determine whether mobile attribution is a must-have in your marketing stack or a nice-to-have.

These factors can include company stage and size, marketing team technical skillset, budget, legacy tech interoperability, and personal preference among others.

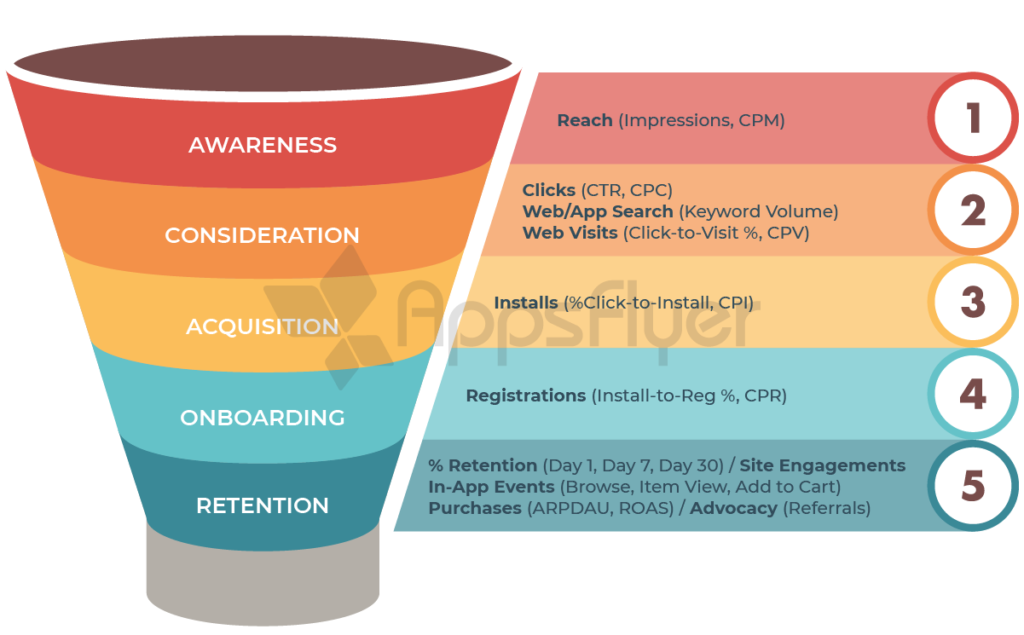

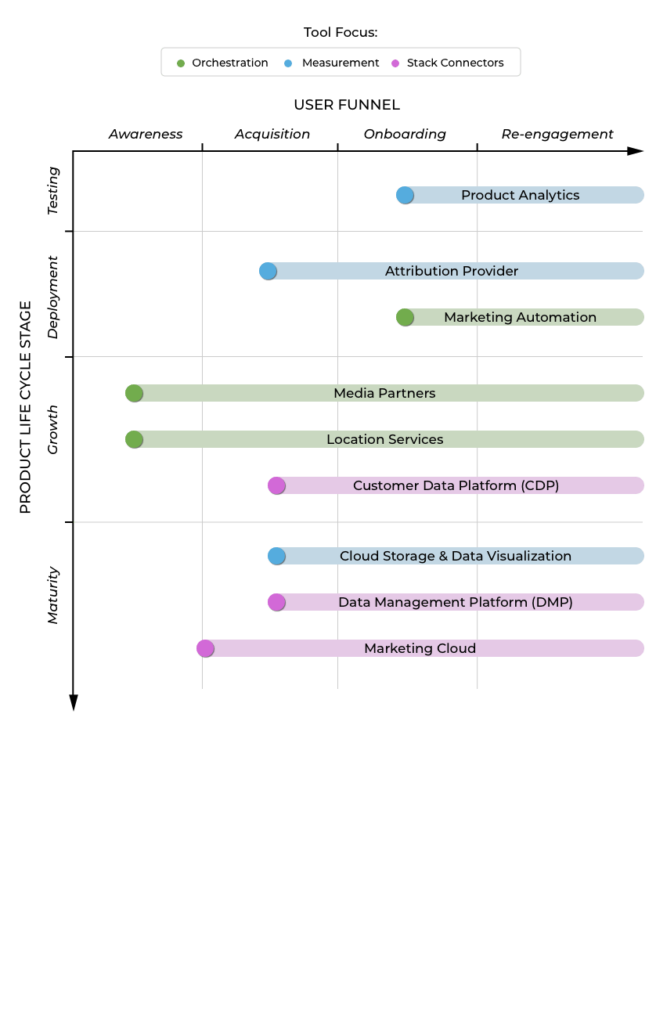

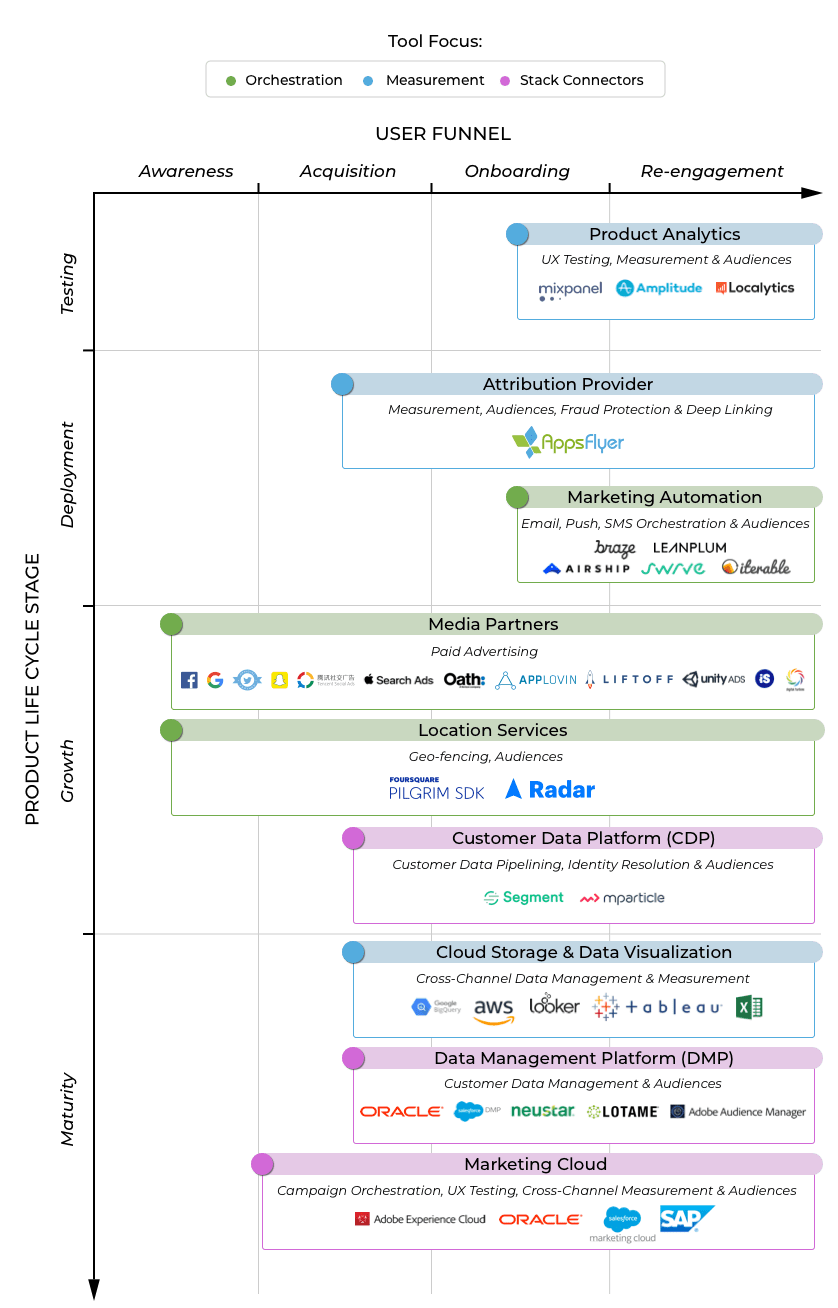

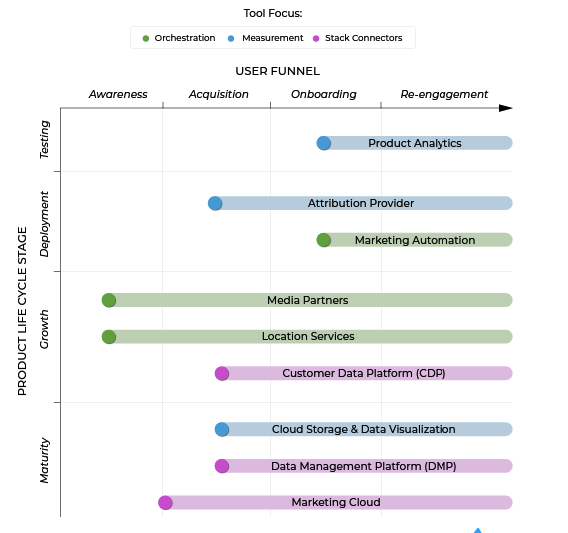

The following graphic illustrates a mobile marketer’s typical hierarchy of needs throughout the product lifecycle vs. each solution’s role across the user funnel.

The order across lifecycle stages indicates the categorical priority from a must-have standpoint, but does not necessarily reflect the most logical order for sequential integration.

For example, BI tools such as CDPs, data visualization and cloud storage tools could be considered the foundational core for a connected tech stack.

Although you don’t need all of them to get started, if you’re designing for scale you might want to consider integrating some of these solutions sooner than later.

Have a look at both views of the graph:

With this hierarchy in mind, let’s start to define the individual components:

- Product analytics:

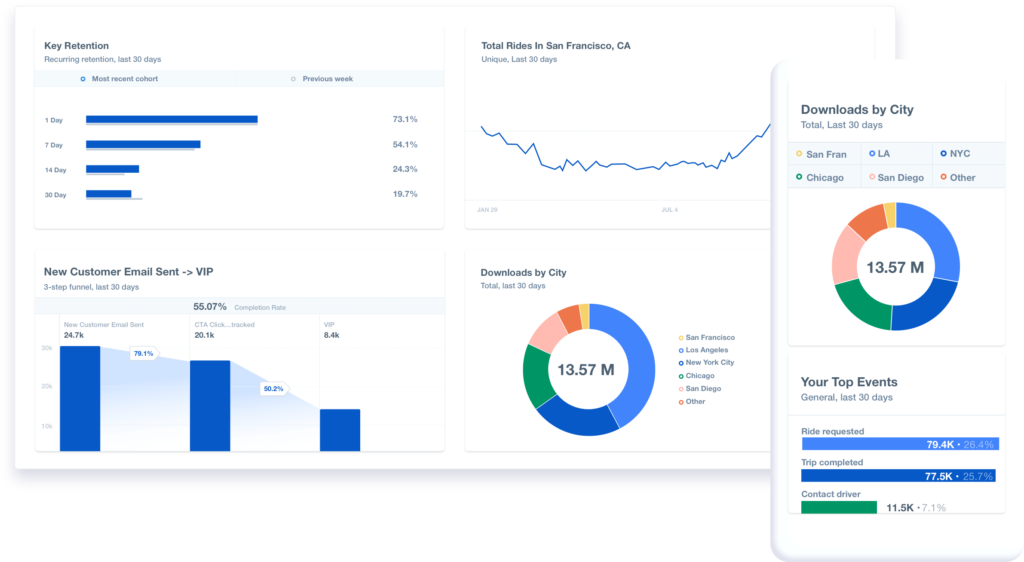

Focused on mobile app experience, product analytics companies specialize in UX testing and persona categorization. Through behavioral and predictive analytics, they provide an easy structure for product optimization in addition to advanced reporting on retention metrics, user funnels and cohort analysis.

For new apps, it’s obviously crucial to have a measurement plan in place for UX testing prior to launch. However, we generally see app start-ups begin with basic measurement from free tools such as Firebase and/or in-app analytics provided by mobile attribution and marketing automation providers, prior to investing in product analytics tools with more advanced mobile data such as Amplitude and Mixpanel.

Likewise, web-first companies expanding to build their first app often lean on web-first analytics tools such as Adobe Analytics early on in their app lifecycle. - Attribution provider:

The core functionality of partners like AppsFlyer is mobile attribution—measuring and attributing every app install and in-app engagement to the marketing campaign and media source that drove it. Although some might not consider attribution providers to be “necessary” until paid media begins, it’s important to remember that most marketing automation providers do not provide tools for universal deep linking.

For example, OneLink by AppsFlyer allows marketers to create a single link that can automatically detect each user’s platform and app state (installed or not) in order to send them to the optimal web or app page. Deep linking is crucial not just for paid media, but also for owned media such as email, webpages, and SMS.

In addition to mobile attribution and deep linking, attribution providers also provide 1st party audience segmentation, fraud protection, advanced analytics and depending on the provider, people-based attribution to connect customer touchpoints across web, app, and TV. - Marketing automation:

Marketing automation partners such as Braze and Leanplum focus on re-engagement with existing users via CRM channels and the core product. Customer engagement can be paired with audience segmentation and A/B testing through push messaging, email marketing, in-app communications or SMS. - Media partners:

Media partners such as Google, Facebook, and Amazon provide advertising inventory across mobile app, web, and TV to drive awareness, acquire new users and re-engage existing users.

Media partners can be used to serve ads via various channels and formats – including social, display, video, native and more. You can read more about media partner subcategories in our Getting Started with Mobile Attribution guide. - User acquisition platform:

While not included in the infographic above, in some ways UA platforms can be considered an extension of the media partner category. Also referred to as Campaign Management Platforms, UA platforms enable marketers to manage, optimize, and analyze their activity across multiple channels using a unified interface, often with at least some level of automation. In addition to automating processes such as creative testing and bid management, UA platforms also have the added benefit of cross-source insights.

As UA platforms tend to be more valuable for performance marketers who manage complex media campaigns across many partners, they tend to be adopted later in the product lifecycle. - Location services:

The King of Cannes 2019 was none other than Burger King, and in their award-winning marketing use case, they demonstrated the power of combining private location preferences data with marketing automation and user acquisition. Location Services effectively give the ability to indentify users against distinct geofences in an easy, interoperable, and flexible way.

This means being able to set up geofences on the fly and ensure that marketing data makes its way to your CDP, attribution and marketing automation tools.

Similarly, it incorporates the ability to tie competitor and other places of interest into your user segments for targeting—all without compromising user security and privacy data, as The New York Times recently reported. - Customer Data Platform (CDP):

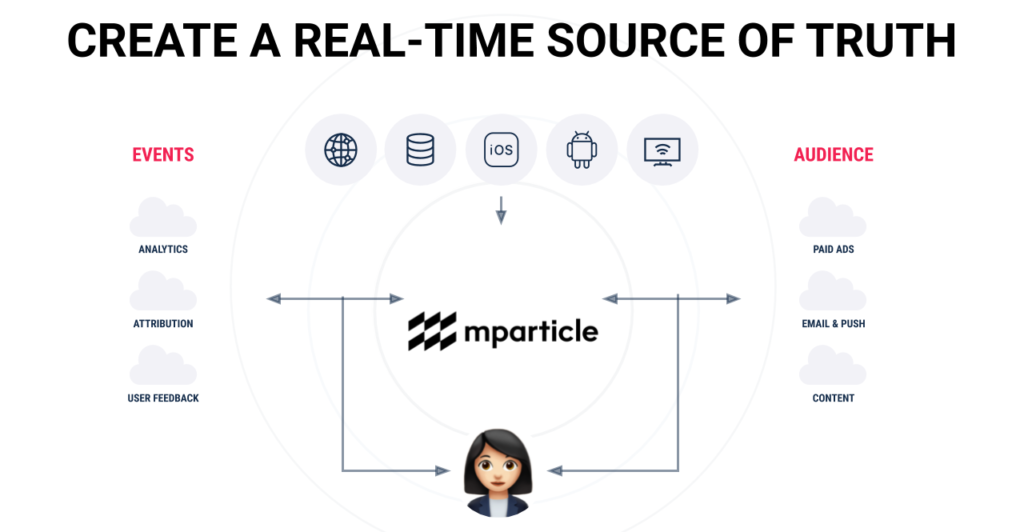

An emerging player in the marketing tech world, CDPs such as mParticle and Segment collect, unify, segment, and activate user data from various SDKs.

CDPs automate and enrich the assignment of customer data segments between all other systems in an advertiser’s tech stack in real-time. This not only makes it easier to set up new SDKs but also maintains consistency for aggregated raw reports downloaded from data warehouses and visualization products. - Cloud storage:

Cloud storage providers and data warehouses maintain, manage, and remotely backup raw data across all of your tech stack systems. Providers such as AWS, Microsoft Azure, Google Cloud Storage, and Snowflake provide a secure and scalable way to store and access massive amounts of raw data across your organization. - Data visualization:

The simplest data visualization is typically done via spreadsheets (i.e. CSV, Excel, Google Sheets), but this format may become too manual or unscalable as your business grows. For this reason, more advanced teams often work with products such as Looker and Tableau to create online dashboards, statistical models and automated reports. - Data Management Platform (DMP):

DMPs are used to collect audience data across platforms, devices, and channels. Unlike MMPs, DMPs not only collect 1st party data but also 3rd party data to map demographic, psychographic and firmographic segments.

Most media partners are able to access 3rd party DMP data for you (charging a mark-up for audience targeting), but some advertisers choose to work with their own dedicated DMP to facilitate standardization across 1st/3rd party audience management. - Marketing cloud:

Perhaps the broadest partner category, marketing cloud companies offer services across the entire spectrum of MarTech, AdTech, and BI Tools (in spite of their categorization under marketing automation above). Marketing clouds such as Adobe, Oracle and Salesforce provide customer identity management, audience tools, campaign orchestration and analytics across a full suite of channels including mobile, web, TV and offline CRM.

Some cloud providers also offer additional products such as CDPs, data management platforms (DMPs) and demand-side platforms (DSPs).

Now that we’ve covered definitions, let’s dive deeper into the specific features and use cases for some of the top tools for digital marketing: attribution, marketing automation, product analytics, CDPs, and UA platforms.

Category deep dive: Mobile attribution

Between paid media campaigns, owned channels, and app store optimization, user acquisition (UA) is a fundamental piece of your mobile business, given that:

- It facilitates growth in the hyper-competitive, free-to-install app ecosystem

- Organic app discovery is largely broken

- UA is the gift that keeps on giving, with effective practice leading to higher app store rankings + more UA

One of the most powerful tools for transforming complex data into actionable insights for UA is the attribution provider, also known as a mobile measurement partner (MMP) in the app world.

While capabilities vary somewhat between providers, MMPs offer a variety of tools including deep linking, mobile fraud protection, first party audience segmentation, and of course, attribution.

Mobile attribution is the process of measuring and attributing every app install and in-app engagement to the marketing campaign and media source that drove it.

Without attribution, marketers lack the right kind of visibility into their performance, which informs wrong decisions and ultimately overspending. In order to make sense of it all and pay their media partners for demonstrated value, marketers need to work with a partner that has a view from above and is a source of truth that can rule which marketing activity should be credited for delivering a desired action and which should not.

Fitting mobile attribution into your MarTech stack

As the centrality of the mobile app as the ultimate destination becomes adopted as a standard, marketers need less convincing as to an attribution provider’s role in their efforts.

Nevertheless, a common misconception is that an attribution provider isn’t relevant for non-paid efforts.

However, there are two key reasons to integrate mobile attribution early on in your product lifecycle, before paid media begins:

- Attribution is centered on understanding engagement with both paid and owned media across the user journey, from ad exposure to push notifications and customer emails.

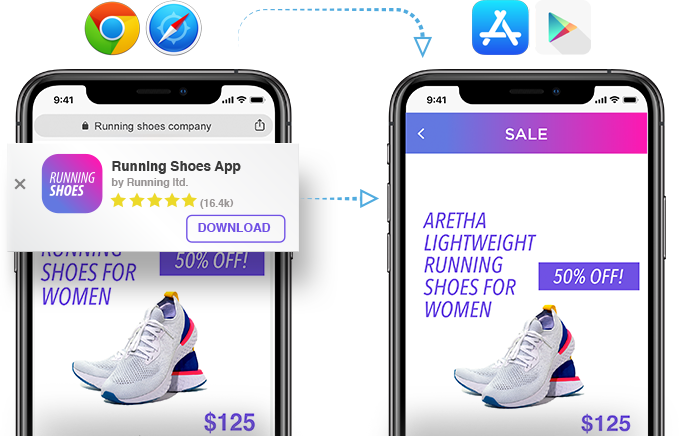

Attribution is crucial for optimizing post-acquisition user flows through the measurement of in-app events such as sign-ups, purchases and level completions, in addition to down-funnel metrics such as retention, revenue and lifetime value (LTV). - Using information gathered by an attribution provider, deep links allow marketers to create a single link that can automatically detect the user’s device, channel, platform and app state (installed or not) to send them to the optimal web or app page.

While deep links are helpful for automating paid link trafficking, they are absolutely crucial for optimizing the user experience for owned media.

When opening a marketing email link on your mobile phone, for example, you’ve probably encountered the frustration of being sent to that brand’s website instead of the app store. This is even more cumbersome for apps that you’ve already installed, in which case you have to exit the webpage, open the app and manually navigate to the intended in-app page.

This is precisely why universal links are so important.

Without using a third party deep linking solution, marketers have no way of optimizing the experience by device and platform.

And while some email service providers (ESPs) and marketing automation platforms have come up with their own universal link solutions, few are equipped to handle every edge case.

AppsFlyer’s OneLink solution solves that, ensuring a seamless user experience across paid advertising, SMS campaigns, user invites, web-to-app banners, cross-app promotions, referral programs, QR codes and more.

Note that, without attribution data on where, when, and how users engage with promotions and apps, deep linking cannot be fully optimized—these two capabilities go hand in hand.

That is, deep linking is the process of using attribution data to route the user appropriately. Since deep links are powerful tools at any stage of your app’s growth and development, it’s crucial to find an attribution provider to unite deep linking and attribution in a single dashboard and maximize the impact of both.

Now that we’ve covered the top two reasons to integrate attribution early on in your product lifecycle, let’s dive deeper into more advanced functionalities and use cases.

Top attribution use cases

While there are many applications of attribution data depending on the marketer’s tech savviness, here are five of the most universal and wide-reaching use cases:

1. Break down the silos between paid and owned media

In many ways, an attribution provider can be considered the common link between advertising and martech partners. In addition to providing deep linking functionality across paid and owned media, attribution data is crucial to unify the two.

By differentiating the source of in-app events between paid re-engagement and marketing automation campaigns (push, email, etc.), marketers can better synchronize and deduplicate efforts to maximize their return on investment (ROI).

Through built-in partner integrations, MMPs allow marketers to unify measurement from all their advertising partners, providing holistic attribution data to product analytics, marketing automation, developer tools and other stack partners to customize web and in-app user flows by audience and acquisition source.

MMPs also prevent the need for a marketer to integrate new SDKs for every new advertising partner, streamlining the testing process while facilitating a continuous feedback loop for media optimization through the use of postbacks.

2. Optimize campaigns with advanced attribution and analytics

From user acquisition to retargeting, effective campaign optimization requires granular measurement.

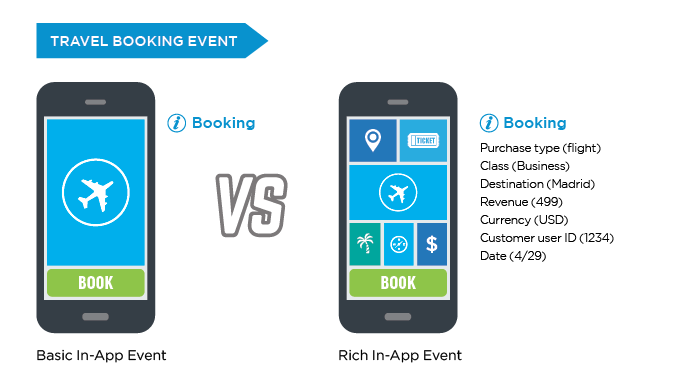

For example, a travel app might focus on basic events such as installs, app opens, registrations, add to cart and bookings as their key performance indicators (KPIs).

However, by mapping additional parameters such as origin, destination and class on both content search and booking events, the airline marketer can unlock more granular options for optimization as well as audience segmentation.

Rich in-app events are the ideal attribution tool to determine the value of app users and the quality of traffic originating from different media sources. Additionally by analyzing the correlation of specific rich in-app events that tend to precede lower-funnel goals such as bookings and purchases, marketers can build predictive models to better optimize towards ROI and ultimately LTV.

In addition to providing granular measurement of in-app events, attribution providers can also connect the dots between different channels and devices to provide a holistic, people-based view of user journeys within a single dashboard.

For example, AppsFlyer offers multi-touch attribution to differentiate the last touch that drove a user to install vs. “contributor” media sources that a user may have been exposed to previously across web and app environments.

Whether viewed as raw data, cohort reports or other dashboard visualizations, these insights can be used to optimize end-to-end user journeys from awareness to UA and re-engagement.

With that clarity, marketers are better positioned to combat ad fraud, reallocate advertising spend, and prevent double or triple charging by ad networks each claiming credit for an install or other action.

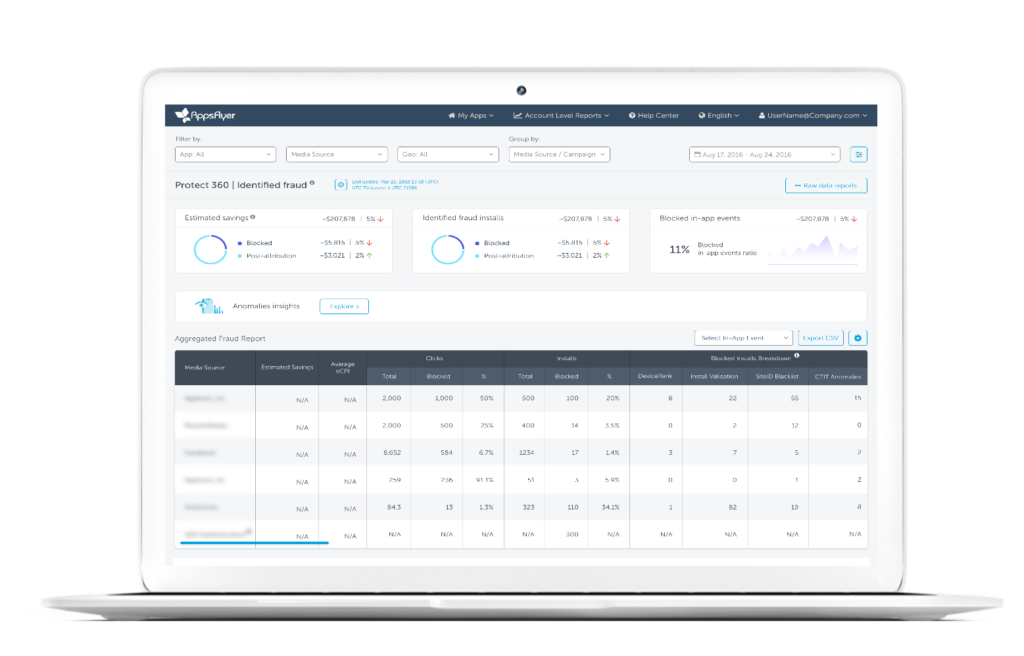

3. Detect and prevent ad fraud in real-time

Mobile ad fraud is a growing industry problem, comprising 22.6% of non-organic app installs worldwide, according to AppsFlyer’s State of Mobile Fraud report.

Although it’s possible to manually detect certain types of fraud by analyzing click-to-install times, conversion rates and other metrics in-house, policing media partners without the use of anti-fraud technology is a cumbersome and only partially effective process.

Fraud is a cat-and-mouse game in which fraudsters are constantly finding new ways to evade detection, such as the use of bots to emulate real users. Given its dynamic development, the best way to stay ahead of sophisticated fraud tactics is by using the massive scale of MMP data to power AI detection and blocking.

By investing in an advanced solution such as AppsFlyer’s Protect360, marketers are guaranteed real-time fraud protection, as well as a suite of advanced reporting that can be used to set up custom rules, alerts and enforcement mechanisms for network compliance.

Realizing that 16% of app install fraud is impossible to stop in real-time, Protect 360 is also the first industry solution to provide AI protection against post-install anomalies that contradict standard user behavior.

4. Identify and expand your highest-value users

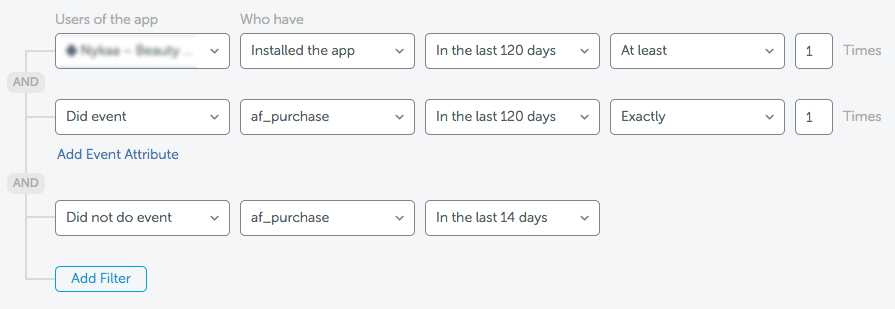

In addition to using attribution data to optimize ad spend and user journeys, you can also leverage an attribution provider’s audience tools to improve the relevancy of your prospecting and retargeting efforts.

By analyzing performance, you can start to understand which actions and metrics correlate most with your highest value users, as well as which types of users are most likely to churn.

Using this insight, you can activate the full potential of your 1st party data by segmenting audiences based on a combination of custom actions and rules, such as ad views, installs, specific in-app events and revenue amounts generated within a set time range.

Rules can be combined and customized to create lookalike audiences modeled off active users, remarketing audiences for new users who have yet to sign up or engage, and exclusions to remove active users from your UA campaigns.

Audience segmentation is also useful for promotional offers, so you can customize the type and value of the offer based on your users’ previous interests and levels of engagement or spending.

Audiences can be synced in real-time to all of your integrated ad partners, in addition to your product analytics partner for custom onboarding flows, as well as your marketing automation partner for email, push and in-app messages that are synchronized with your paid re-engagement campaigns.

5. Optimize user journeys with deep linking and smart banners

As mentioned previously, deep linking is a critical tool for making the user experience with your app and brand frictionless across channels, platforms, and devices.

By providing a more seamless conversion process and enabling contextual experiences customized by a user’s interests, acquisition source, and previous brand engagements, deep links can boost conversion rates by 2.5x and retention by 2.1x.

In addition to optimizing journeys across paid and owned media, deep linking can also be used to convert your web users into more valuable app users through the use of smart banners.

Let’s take eCommerce as an example: Given that 70% of mobile sales occur in app, it’s no wonder that conversion rates are 3x higher compared to web.

Remember that once you convert a user to your app, you can maintain more consistent communications through push and in-app messages.

Leave the data plumbing to the plumber

At this point, you may still not be convinced that a mobile attribution provider is necessary for your marketing efforts.

For example, if you’re entering the app world from an established web-first enterprise, it may be tempting to lean on your marketing cloud or web-based product analytics suite.

It’s true that you can gain some insight from these legacy tools, as well as partial views of your user journeys from marketing automation and free attribution products such as Firebase.

While some attribution functionalities can be built in-house, taking any of these routes is a compromise that may not be worth taking in the long run.

Take the diverse partner integrations, pre- and post-install attribution, universal deep linking, real-time data, and security protocols for audience data which are only supported by a complex network of mechanics.

Such mechanics might not be realistic to build and maintain for companies working with limited team members and resources. Pair this with the complications of working in multiple environments with different methodologies – mobile web and mobile app, for example – and the possibility of things going wrong only increases.

Another consideration is the extent to which you can effectively protect yourself from fraud.

Due to the inability to manually counteract every form of fraud, and the time required to continuously update in-house technology to keep up with new fraud tactics, the ROI from a third party anti-fraud suite is usually worth the cost. Attribution providers are far better equipped to fight fraud with their resources, expertise, and scale.

Ultimately, no matter where you are in your app growth or what goals you may have for your data and optimization, an attribution provider can lend invaluable insights and capabilities at multiple stages along your journey.

Category deep dive: Marketing automation

This chapter was written in collaboration with Braze

Great automated customer engagement strategies can be challenging for brands.

Think about the times you’ve received a push notification or email gone wrong.

Was the content not tailored to you at all? Did you receive the message way later than you expected to receive it? Were messages sent to you multiple times?

It’s all happened to us – and when it happens, it can have a big impact on the brand at fault.

Some customers may opt out of that notification channel so that they don’t get that kind of messaging in the future. Others might even uninstall the app or never purchase from that company again. In either scenario, ineffective customer communication can have severe business implications.

Consumers today expect a seamless experience with your brand across devices and channels.

In addition, they’re becoming more critical of the quality of content that brands send them.

And we’re beginning to see these customer behaviors and preferences reflected in the tech landscape – just look at the way Apple has given consumers more control around their push notifications and Notification Center.

This shift makes it more important than ever for brands to approach customer engagement thoughtfully from the start.

At the end of the day, we’re all human.

In order to build meaningful human relationships, brands need to understand their users so they can personalize experiences in ways that speak to each individual.

By integrating marketing automation as one of the first tools in your martech stack, brands can more effectively personalize customer experiences at scale.

Marketing automation platforms, also known as customer engagement platforms, help brands orchestrate, test and automate engagement with their customers through owned channels such as in-app messaging, push notifications, email marketing, and SMS.

Building an integrated technology stack for customer engagement

Marketing technology stacks come in different shapes and sizes.

Start-ups may get by with internally-built systems for push and email services. However, as companies grow, it becomes more difficult to effectively scale and automate campaigns without involving significant analyst and engineering resources.

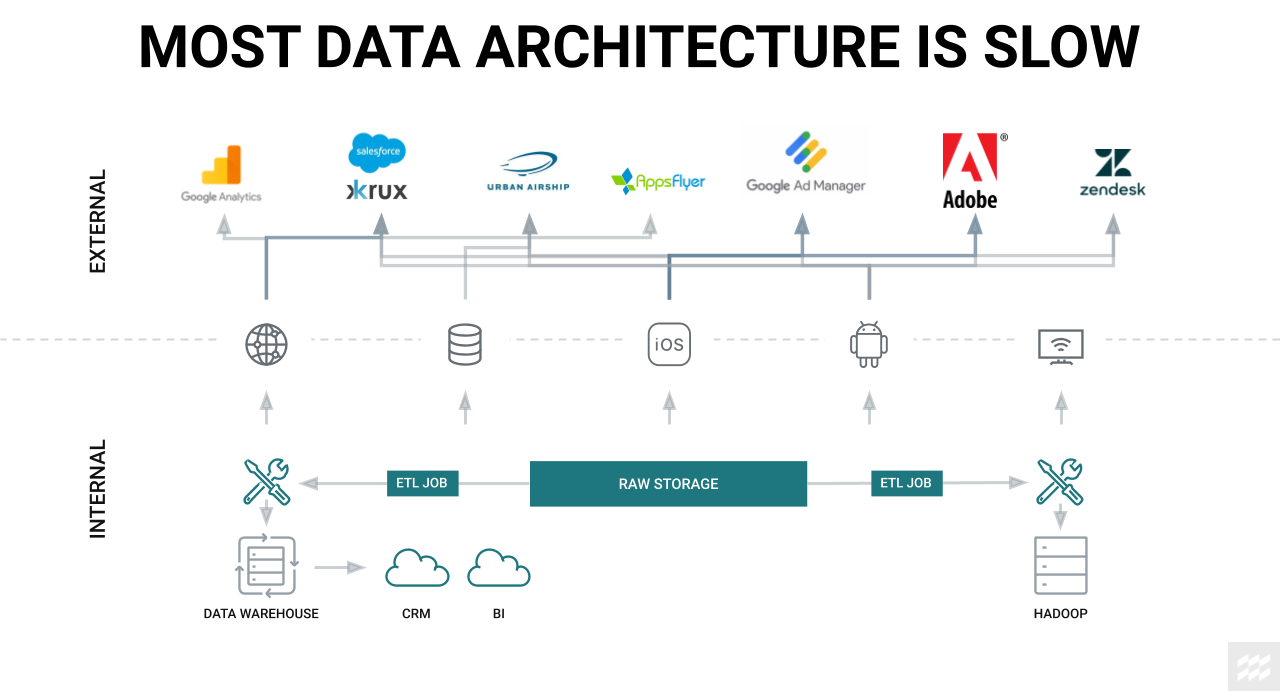

In recent years, we’ve seen a shift in how brands are thinking about data agility.

Previously, brands found it challenging to consolidate 1st and 3rd party data. It required countless hours of engineering resources and Excel analysis to build and optimize marketing campaigns. These manual processes also made it difficult for brands to action and iterate on cross-channel data in real-time.

As technologies become more specialized, brands are now building integrated marketing technology stacks with connectivity and data agility in mind.

Today, marketing automation platforms such as Braze empower marketers to be more nimble and efficient in orchestrating their customer engagement strategies.

Brands are able to filter large datasets or enrich their data from third-party integrations such as AppsFlyer or Mixpanel to build targetable audiences. By analyzing the results of cross-channel messaging tests by audience segment, brands can build smarter, more relevant messaging flows.

For example, audience filtering can be linked to rules that trigger real-time messages after customers complete specific events in your mobile or web experiences and, taking this a step further, Braze’s Connected Content feature allows you to build 1:1 personalized content with your customers at scale via API triggers.

Rather than working in silos, cross-channel messaging can now be orchestrated within a single interface such as Braze’s Canvas, allowing you to automate synchronized messaging for email, push, in-app messages, and in-app content feeds across web and mobile.

Partner integrations can also extend messaging to other channels such as paid advertising, SMS, and direct mail.

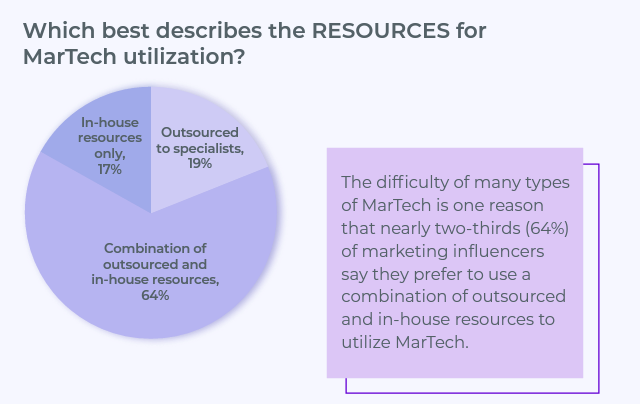

As the above graphic illustrates, these use cases become even more powerful when your marketing automation platform is integrated for holistic data collection and ingestion across your tech stack.

For example, many brands find it useful to employ a CDP such as mParticle or Segment to consolidate, centralize and standardize customer data across first- and third-party systems, enabling real-time data flows between tech stack tools.

This enriches the data available for marketing automation and in turn, allows marketing automation data to be shared with product analytics and attribution platforms – allowing brands to quickly synchronize audiences, messaging and learnings across paid and owned campaigns.

Likewise, as most marketing automation platforms lack a universal link solution, the previous chapter in this guide emphasized the importance of deploying deep links from an attribution provider such as AppsFlyer across all marketing channels.

In addition to using deep links to automatically route users to the optimal web or app page, attribution data can be used to customize the triggers that are applied to cross-channel marketing automation campaigns.

Building brilliant customer engagement experiences

An integrated marketing technology stack can unlock endless opportunities for brands to build meaningful experiences with their consumers.

Let’s look at some best practices for building great customer experiences.

Personalize onboarding flows to make a lasting impression

The first few days of acquiring a new customer are crucial. If customers don’t see value out of your brand early on, they will most likely churn.

Brands should ultimately help customers with two main things:

1. To feel welcome in their app or web environment

It can be as easy as sending a warm welcome email or thanking them for signing up.

One way of getting to know your customers is asking them what channels they’re interested in receiving messages on.

Push notification opt-in prompts via in-app messaging have been widely used across web and mobile devices as a means to ask for permission and highlight the value of the content the customer will receive if they enable push.

Note: If you are sending attribution data from AppsFlyer into Braze, you can also tailor the onboarding experience and content based on the source from which the customer was acquired.

Using consistent messaging and imagery from the very first impression can do a lot to make your brand experience familiar, comfortable, and compelling.

For example, if customers installed after viewing a Google ad with a promo code, you could target these customers with a triggered in-app message when they log their first session or send those customers emails that highlight the same promo.

2. To be able to use your app or website to see real value, right from the start

Ensure that you build educational strategies upfront to get new users engaged with your app or website. Create easy milestones for customers to hit in order to gain familiarity with your product or service.

If you have an eCommerce app, for instance, you could highlight how easy it is to discover products, purchase and get rewards from purchasing again in the future.

Each new customer journey is unique.

For more best practices, check out the Braze guide to building a personalized cross-channel onboarding experience.

Continue to build rich customer experiences post-onboarding

Getting new customers through onboarding is just the first step.

Building a long-lasting relationship can be challenging, as it takes time and consistent engagement to really stick.

Here are a few tips:

1. Ensure you continue to stay top-of-mind by responding to your customers’ needs and behaviors

There might be moments within your user experiences where customers have taken an action that’s close to hitting a milestone or driving a conversion.

Give them a little push!

By triggering a responsive message, your customers will receive timely and relevant content that highlights the value of taking that last step. Maybe forgot about the item they put in their cart. If they’re playing a game, maybe they had to stop playing but need a nudge to get back into the app to complete the level.

Whatever the motivation is, event-based triggering is a great way to continue that conversation with your customer

2. Ensure that each message is relevant and timely

Many brands are guilty of an over-reliance on blast messages.

The result? Increasing numbers of unsubscribes, push opt-outs, and even uninstalls.

Don’t fall into this trap.

Although there are some instances where audience-wide communications are necessary, including GDPR-related communications or Terms of Service updates, in most situations it’s better to use your customer data to make each message count. Tailor the content of each message based on specific sections of your app or website that each customer has interacted with.

For example, if a user of your gaming app exits the app after completing level 9, then send a quick push reminding them how close they are to completing level 10.

Furthermore, APIs can be used to unlock powerful segmentation and trigger options for in-the-moment personalization. From product recommendations to personalized messaging based on real-time weather forecasts, dynamic content can have truly powerful results.

3. Effectively communicate across multiple channels

Each customer has different preferences about how they want to receive messages.

Therefore, it’s important to give your customers the option to select what types of messages to receive (and how to receive them) through your notification preference center. By offering customers a choice, they will be less likely to opt out of a channel entirely.

Cross-channel cohesion is imperative for successful engagement, as each messaging channel has a different purpose. Push is great for short, direct content like alerts or reminders, whereas email is beneficial for providing more context like getting started tips.

Regardless of the device or channel, deep links should always be used to ensure a seamless conversion experience with attribution data baked in.

From there, a cyclical flow of data will allow you to understand how your customers respond to each channel and personalize their journeys accordingly.

Final thoughts

Customer engagement is at the center of today’s integrated technology stacks.

Improvements to data agility have given brands the ability to identify and understand each of their users across first- and third-party data sources in real time. As a result, brands can tailor experiences to each individual customer to have personalized conversations across multiple channels.

The importance of this cannot be understated, as effective cross-channel messaging strategies have the potential to boost customer engagement by 844%. Humanizing the digital experience will lead brands to increased customer loyalty and ultimately improved business outcomes.

Category deep dive: Product analytics

This chapter was written in collaboration with Mixpanel

Growth has ushered in an era where the science of big data is crucial to offer the best customer experience. From awareness to onboarding and re-engagement across web, app, and physical locations, each brand touchpoint attempts to create a unique user experience captured by data and optimized by the interpretation of it.

In the previous two chapters, we highlighted the importance of mobile attribution and marketing automation to optimize the journey through user acquisition, retargeting, and customer engagement.

Although both of these technologies provide in-app analytics that facilitate user understanding, they were not designed to optimize the core product experience itself.

It is for this reason that product analytics has become the bedrock of high-performance product, marketing, and growth teams.

Product analytics is the study and understanding of your product and business through the analysis of your users, their journey through your product experience and their success across various outcomes.

Traditional, non-digital businesses often lack the benefit of massive data teams, top talent, cutting-edge machine learning models, and the people, organization, and processes to effectively manage user understanding, experimentation, and growth.

That type of exercise can take years even among the most polished business environments.

Realizing this, companies have turned to self-serve product analytics platforms like Mixpanel to solve complex digital-first needs, from behavioral analysis to user segmentation, and activation across web and mobile.

The product analytics category didn’t develop in a vacuum.

Rather, it evolved as legacy, all-in-one technologies failed to meet the needs of digital-first companies, while at the same time the activation energy to DIY was too much to overcome.

The power of self-serve product analytics

Product analytics tools bring marketers, product managers, engineers, and data scientists together under a single platform designed to test, understand, and optimize the product experience across devices.

They provide numerous self-serve use cases, including funnel flow optimization, cohort analysis, user segmentation, and integrations with other stack partners. More advanced product analytics platforms like Mixpanel also provide targeted engagement functionalities that intersect with marketing automation—including push, email, SMS, and in-app messaging.

The core emphasis of modern product analytics tools is self-serve (i.e. no dependency on a business analyst) because, without this, you quickly find yourself wading through BI tooling warefare.

Product analytics facilitates data democratization, enabling cross-functional teams to answer complex behavioral queries without the overhead of a data scientist writing SQL.

This allows core business units such as marketing and product to move fast, be flexible, and answer the majority of their data and user behavior questions in minutes, rather than weeks.

Likewise, it protects some of your most important and expensive resources – data scientists – from answering basic KPI questions, creating basic dashboards, verifying data, and instead allows them to focus much more on strategic, high value, and extremely complex problems.

Ultimately, product analytics overcomes three crucial hurdles in the growth cycle:

- Understanding user engagement, the customer experience, and the complete lifecycle through your product – from upstream marketing touchpoints (e.g. clicks, attribution) to downstream user data (e.g. events).

- Improving the customer experience through deep KPI analysis and robust digital analytics capabilities.

- Driving positive business outcomes by leveraging this understanding to activate in-platform messaging capabilities or pre-built partner integrations.

With a generalized understanding of product analytics, let’s explore a few core use cases within the broader framework of a marketing tech stack.

Example 1: Understanding users with behavioral analytics

Take a common example of a Fortune 500 retail app, where the client – a user acquisition marketer – is trying to understand the user journey by analyzing conversion rates from paid advertising to install to lower-funnel metrics that drive bottom-line revenue.

UA marketers are interested in a few things.

- They want to understand the rate at which users convert to their core metric – for a retail app, this is purchasing products

- They want to understand how they got there and what drove their attribution.

Attribution can be broken into objective and subjective measures.

Let’s talk about objective measures first.

The acquisition funnel starts with the user clicking on an ad shown from one of the client’s media sources, such as Facebook, Google, or Apple Search Ads.

Through deep linking, the user navigates from the ad to the website, the app if they have it, or the app store to install the app.

Once the user installs and opens the app, the attribution provider (e.g. AppsFlyer) attributes that user to the right media source so the client can objectively measure which media sources and creative variants drove the most efficient conversions.

After the installation is where subjective measures of attribution come into play.

Ultimately the marketer will be interested in understanding their return on ad spend (ROAS).

This is a function of the user’s experience with both the acquisition source (the ad itself + deep linking UX), as well as the onboarding experience within the app or website. Following that initial onboarding experience, additional factors can either help or hinder the flow that ultimately leads the user to check out and purchase.

While the UA marketer can draw valuable conclusions from attribution metrics, the ability to dig in, analyze that experience, and map the flow of the user across a multitude of events such as login, category selection, add to cart – that is what makes product analytics so essential.

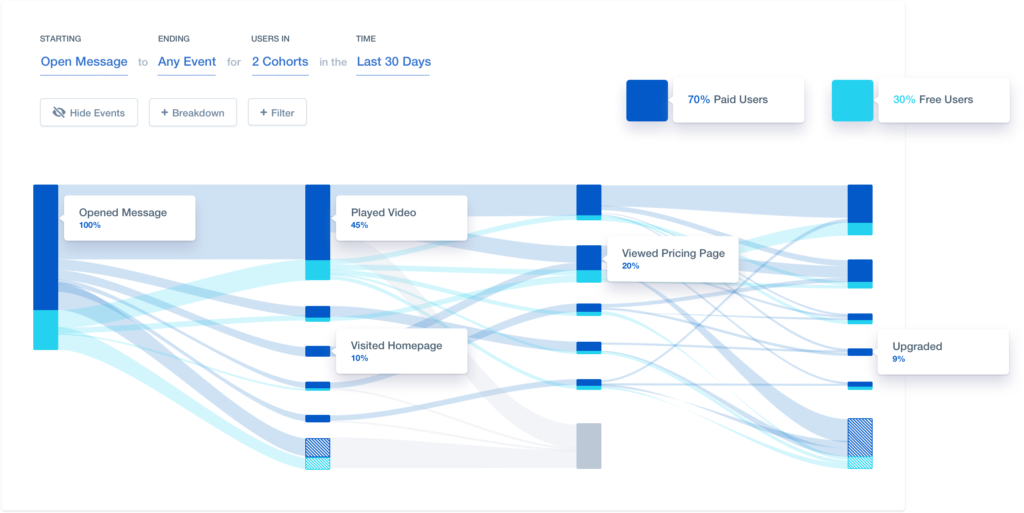

Within Mixpanel, one tool to understand this journey is our Flows product (above).

This allows marketers and product managers to map out the most common flows the user might take and their respective conversions – and identify any roadblocks to onboarding, or poor user experiences that prevent the marketer’s hard-earned dollars from contributing to successful conversion outcomes.

While Flows provide a top-line view, the bread and butter of product analytics tools is in segmentation, funnel, and retention analysis and cohort grouping. Each of these standalone features facilitates a deeper understanding of user behavior.

For example, Mixpanel’s Funnels report allows you to see how your users are converting along a defined event pathway. This means you can identify opportunities to increase conversion rates by nailing down when and where users drop off (or fail to convert) in your product cycle or in your marketing campaigns.

Likewise, the Retention analysis product allows teams to see if new users who try your product each day, week or month are coming back after you add, modify or improve features or flows.

From these analytics capabilities, teams can take action of their own, whether it be reporting this data to their key stakeholders and company decision-makers, deciding which paid media platforms to invest in, or choosing which product flows to modify with help from engineering and product.

Example 2: Optimizing messages and flows with cohort analysis

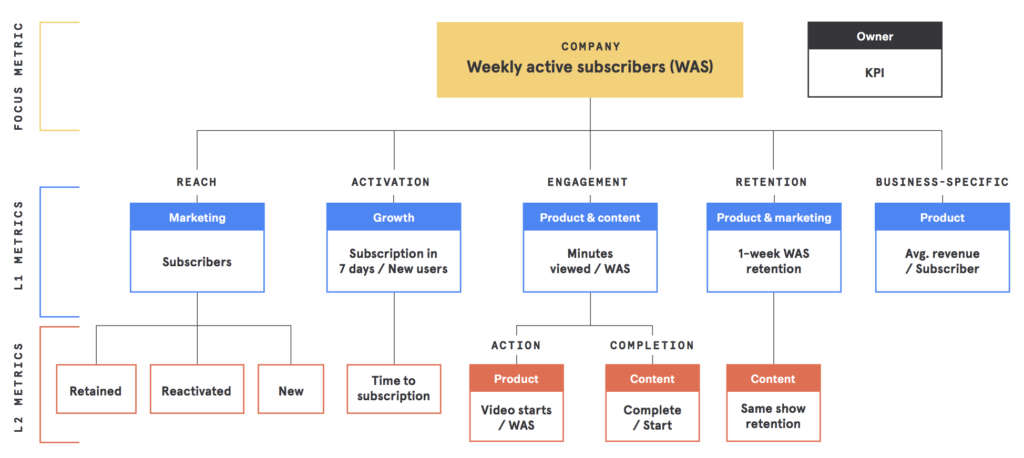

For even deeper analysis and improvement, let us take another example, this time of a subscription-based video streaming company that wants to understand how to best serve its users with relevant content.

Once the user is acquired and attributed to the right source from an attribution provider, it’s important for the video streaming company to know how much time the user is spending and on what content they are spending more time on.

Frequency and repeat consumption are core metrics for their success.

If the product team is working on a new AI-based content suggestion interface, it’s important for them to analyze how many hours of particular content the user is watching. Thus, they could create cohorts based on the type of content and hours watched.

The product team might create these cohorts and feed the data in a raw data format to their AI and ML models. Or they could export these cohorts back to the marketing team’s attribution tool, like AppsFlyer. The marketing team could also create its own cohorts for comparison, examining retention rates vs. drop-off rates from specific content or within a certain time duration.

The possibilities for activation are limitless.

Product and marketing teams can work together to customize onboarding flow experiments by combining attribution data (media source, campaign, ad type, etc.) with product analytics cohorts.

In Mixpanel, cohorts can be further activated with our built-in messaging capabilities or our integrations with marketing automation partners. Ultimately, the only bound is the team’s creativity and motivation to experiment and iterate.

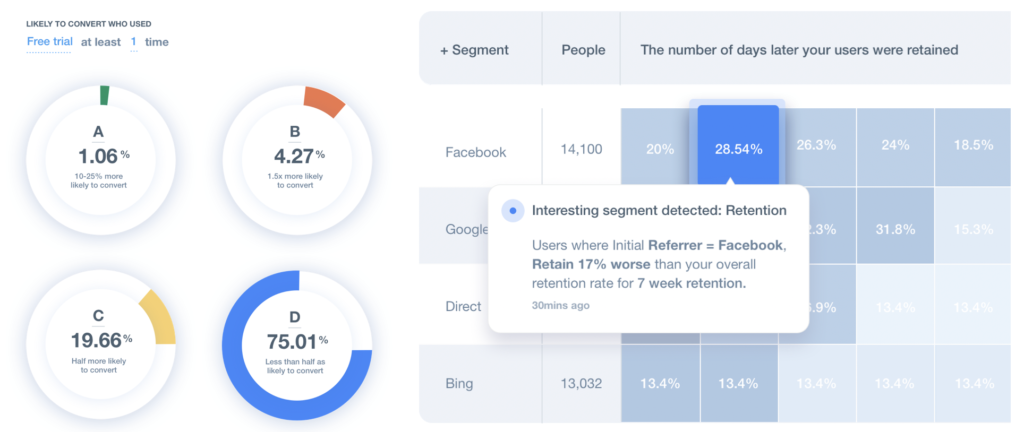

Example 3: Predictive analytics for data science

In addition to customizable reporting and segmentation, some product analytics platforms, including Mixpanel, have additional AI applications to unlock the data scientist in marketers and product managers alike.

For example, Mixpanel’s predictive analytics model uses past behaviors to surface which users are likely (or unlikely) to perform an action.

This allows you to target potential converters or at-risk users with timely messages and special offers through marketing automation, as well as paid retargeting and incrementality testing via audience integrations with attribution providers such as AppsFlyer.

Right: Know which user segments are causing metric spikes with automatic segmentation.

These insights can be further amplified by real-time triggers such as automatic segmentation and anomaly detection.

Anomaly detection notifies you when important metrics spike or dip unexpectedly for a particular segment, along with the users causing the change.

These automatic insights can be applied to product UX tests, messaging experiments, and even paid media allocation.

Learn more

In each case, product analytics enables down-the-line contributors to take control of their business outcomes and better serve their customers. This empowers teams to be more efficient, propelling growth at every level of an organization and within every individual contributor.

To learn more about best practices for product analytics, check out Mixpanel’s Guide to Product Metrics.

Category deep dive: Customer data platform

This chapter was written in collaboration with mParticle

As the customer experience becomes increasingly mobile-centric, consumers expect brands to be able to understand and speak to them as they jump from device to device, without skipping a beat. Brands now face the problem of piecing together a current, coherent, and – most importantly – complete customer identity from the sea of data points created during every brand interaction across web, app, email, and beyond.

In the Connected Era, marketers need to be able to measure the customer journey in real time, at scale, across channels and devices, while complying with industry privacy standards.

They also need to be able to connect that data with new tools and vendors to continuously test new avenues of growth.

This is where a customer data platform (CDP) comes into play.

Modern, foundational CDPs like mParticle help brands use their own customer data to improve user journeys on mobile and web alike through identity resolution.

More specifically, CDPs facilitate:

- Standardized implementation of new SDKs via CDP partner plug-ins, as well as standardized alignment of data identifiers across each SDK

- Real-time data flows between stack partners that can be used to enrich and unify customer identities for multithreaded customer journeys

- Consistent regulation of privacy standards for customer data across partners

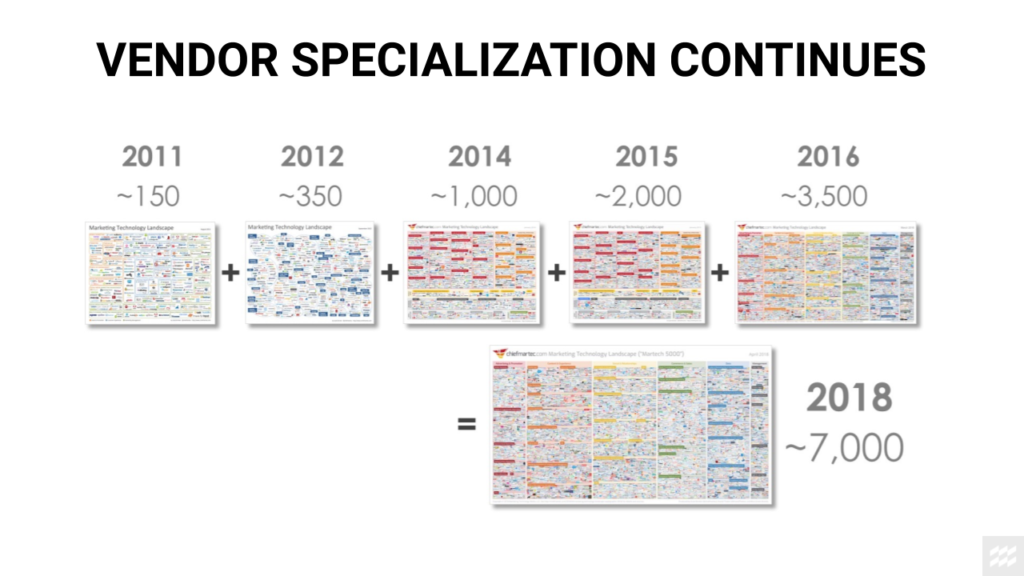

MarTech is more specialized than ever

To keep up with the evolving customer journey in the Connected Era, the average brand’s marketing stack requires more and more tools.

If you look at the martech landscape that has emerged over the past few years, there is a strong trend towards specialization.

That’s both good and bad for marketers; good in that specialized technologies are better suited to address hyper-specific needs like mobile attribution and fraud protection on mobile vs. web, but also “bad” because it warrants a bigger martech stack to gather all of the data necessary to create a continuous marketing experience.

A bigger stack wouldn’t be a problem were data identifiers standardized across tools, but brands are currently faced with a variety of naming systems.

Fortunately, CDPs are able to transform and piece together data from different systems across a data stack to create a single view of the customer, regardless of incompatibility between systems.

This allows marketers to send their customer data seamlessly to pre-built integrations with 250+ vendors across analytics, marketing, business intelligence, and data warehousing.

CDPs help marketers launch and test new tools quickly, as these pre-built integrations require almost no support from developers to set up and maintain.

Real-time data enables multithreaded customer journeys

The operating word in the Connected Era is connected.

Mobile devices have made it so that we are not just constantly connected to each other, but also to our emails, social profiles, apps, and so on. This translates to heightened consumer expectations for brands, who are tasked with anticipating and reacting to customer actions across platforms and devices.

To minimize reaction time and effectively leverage the goldmine of customer data available through best-of-breed stacks, marketers need to be able to access and activate this data across devices in real time.

In contrast to DMPs before them, CDPs use APIs to collect real-time data across the entire customer lifecycle to create comprehensive customer profiles – no matter the source – that can then be forwarded to the services and platforms in your stack so you can take immediate action.

Using real-time data provides brands with a way to contextualize engagements with customers, making their experiences relevant to customers’ preferences and current circumstances.

For example, sneaker retailer GOAT uses AppsFlyer as the source of truth for mobile attribution and mParticle as the CDP to sync data across all the tools in their stack.

mParticle connects GOAT’s event history across mobile and web, such as screen views and items added to cart, which the GOAT team exports to analyze cross-channel reporting.

GOAT also uses mParticle to create audiences and update their marketing automation campaigns in real time to ensure they deliver the most relevant remarketing message. This allows them to optimize the customer experience by designing a user-centric flow that is channel and platform agnostic.

Another prime example of integrated, multithreaded customer journeys can be seen from Burger King’s award-winning “Whopper Detour” campaign.

By using mParticle to link real-time location data from Radar to their paid advertising and marketing automation campaigns, Burger King offered a free Whopper via the Burger King mobile app whenever a customer was within 600 feet of a McDonald’s. This campaign not only propelled Burger King’s app from a ranking of #686 to the #1 across all app store categories, but it also drove the highest foot traffic in 4.5 years.

As these best-in-class examples illustrate, CDPs open a world of options for seamless, interconnected audiences, messaging, activation, and reporting.

Privacy by design

Brands have to accept that customer data is the most valuable asset available to them in 2019, just as customers have started to demand increased control over how their personal data is collected and used.

The wild west of customer data management is no more, with GDPR in full force and upcoming regulation from CCPA in the United States.

Companies relying solely on outdated data management systems that are unable to meet GDPR standards can be forced to face fines equating up to 4% of global revenue or stop collecting data altogether in an effort to avoid punishment. It doesn’t have to be this way; CDPs are designed with privacy and identity at their core, allowing them to meet the new regulatory data standards without sacrificing the insight and actionability provided by customer data.

Bringing it all together

As the glue to unite an interconnected mobile marketing tech stack, there is obviously a huge advantage of integrating a CDP early on for bread-and-butter needs like privacy compliance, cross-channel reporting, and streamlined partner onboarding.

For companies with more mature tech stacks that don’t yet have a CDP in play, adding a CDP may become a more tactical move to streamline old processes and unlock new use cases (e.g. real-time triggering, synchronized audiences for paid and owned re-engagement, cross-channel A/B testing, etc.).

What this all boils down to is the customer experience; the moments that matter in the Connected Era are fleeting and so the margin for conversion is razor-thin.

In 2019, the answer to the marketer’s maxim of creating the right message, to the right user, at the right time, in the right place, is to get the right data, to the right system, in real time.

Simply, you can’t expect to do that if the right system isn’t mapping the right identity, to the right system, all the time.

If you’d like to learn more about how mParticle helps brand win in the Connected Era, feel free to reach out. Or, to learn more about CDPs, check out our in-depth CDP guide.

Category deep dive: User acquisition platform

This chapter was written in collaboration with Bidalgo

User Acquisition is an essential part of marketing in a profit-driven business.

Together with engagement and retention, it creates a cycle that sustains the business and can facilitate its expansion. After all, without users, there’s no business; and without new users, there’s often no viable path for growth.

While user acquisition practices differ from company to company, patterns emerge when we zoom out. In the mobile marketing industry, user acquisition is often the most substantial post-launch marketing investment every year. Frequently, it’s the single largest number on the books for the entire company.

With the expenditure so high, one would expect there to be some framework to govern it. And herein lies the biggest challenge of user acquisition: consistency.

Audiences move from channel to channel, each with its voice and best practices. The breakneck speed of innovation ensures there’s always some new growth hacking workflow to attempt before the entire market finds out about it. Siloed data streams and disjointed KPIs hamper the ability to analyze the entire activity.

The consistency challenge is what User Acquisition Platforms like Bidalgo are here to address.

Their purpose is to bring order to the chaos of user acquisition. These platforms maximize the value of each dollar spent, and each person-hour invested, by creating an orchestration layer for activity management, automation, and analysis above the different channels and measurement platforms.

User Acquisition Platforms, also referred to as Campaign Management Platforms, enable marketers to manage, optimize, and analyze their activity across multiple channels using a unified interface, often with at least some level of automation.

There’s also the added benefit of cross-source insights, unavailable when looking at only one component of the activity.

That is why the largest companies, even with their own robust BI, turn to dedicated platforms for user acquisition.

The three pillars of user acquisition

To understand what User Acquisition Platforms do, we must break down the process of user acquisition into distinct components.

One popular way of doing this is to look separately at the managerial, analytical, and creative aspects of UA.

For each, you’re likely to find some solution within a mature User Acquisition Platform.

- Campaign analysis is the ability to glean actionable insights from individual campaigns and holistic results across all your app activity. Some of these are straightforward (“how much do I pay on average for an ad click?”), while others require processed and cross-referenced data (“who actually saw my ads?”).

- Campaign management is the operational toolset of a User Acquisition platform, enabling UA managers to launch, stop, edit, and refresh campaigns. Although most UA channels provide their own ads managers with robust and easy-to-use interfaces,having a centralized platform to manage dozens of campaigns across several channels is much easier and more effective, leaving UA managers more time to focus on strategic tasks

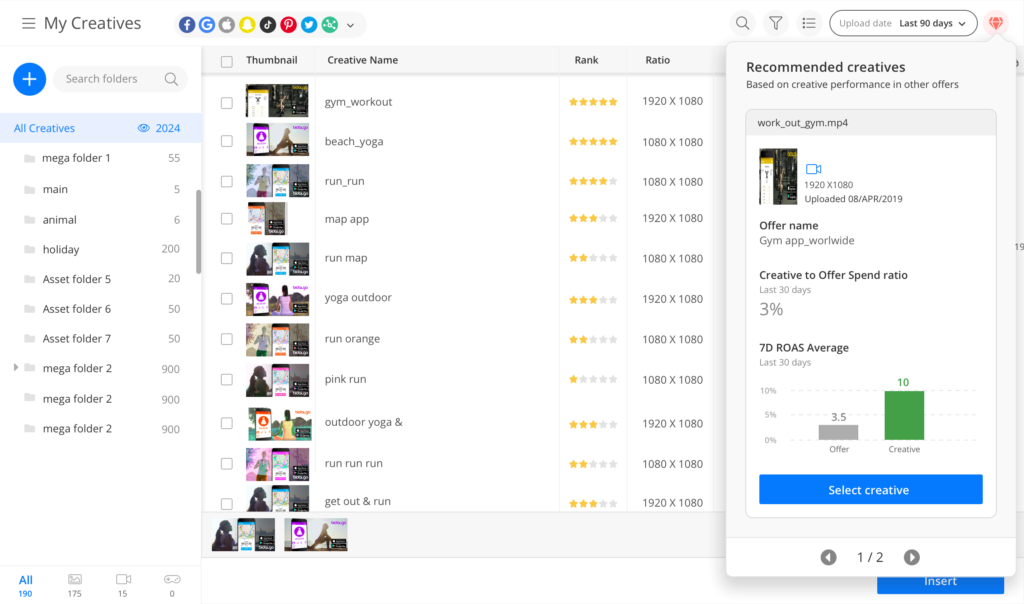

- Creative management is pretty much everything that has to do with the ad creative. Here, there’s no baseline capability level. While some platforms offer limited creative-related functionality, very few have full analysis, insights and auto-production— the capability to generate creative assets based on past successes.

These three pillars often have another ingredient mixed in – automation.

It’s worth remembering that there’s no intrinsic value to automation; what matters is the value derived from it. Still, we live in an age of big data, and UA platforms often find a way to create some value by automating parts of the User Acquisition process.

Deep-rooted problems require bespoke solutions

As we’ve mentioned at the beginning of this article, User Acquisition Platforms are not merely tools of convenience for mobile marketers.

These toolsets are in a unique position to help maximize your advertising ROI, address real pain points and remove growth bottlenecks as efficiently as possible.

The data conundrum

Is there such a thing as too much data? Yes.

Ideally, you work with as much data as you can process efficiently. Ingest less than that, and you’re missing some potentially valuable insights. Collect more, and you will find yourself bogged down by all the noise.

In fact, marketers often handle an average of 10-15 ad networks simultaneously, resulting in hundreds of subsets and thousands of manual actions they need to take in order to maintain their campaigns.

That’s a hugely time consuming and inefficient activity.

But above all, their ability to monitor performance, make correct bids, and take actions in real-time is very limited. It ends up hurting their ability to successfully scale their activity and maximize ROAS.

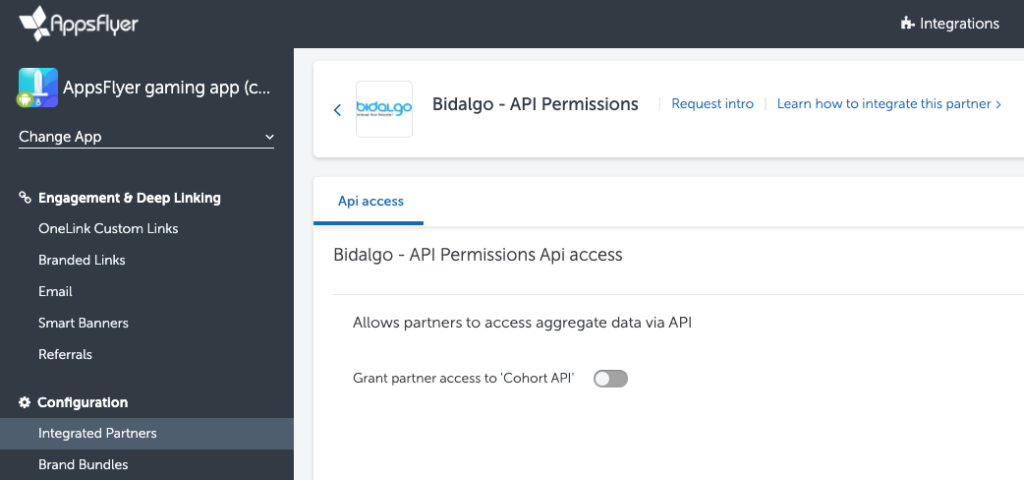

Modern UA platforms significantly increase the data processing capacity of a marketing department, especially cross-referenced data from multiple channels and sources. Cross-referencing is essential for precise, actionable insights, as these can be generated more efficiently by combining channel data with attribution data available through attribution providers like AppsFlyer.

Attribution providers are necessary for smart decision-making, as they can provide accurate and granular attribution data. When done correctly, it’s a complex yet immensely-valuable process, designed to avoid uncertainty in cases such as competing credit claims by media partners. This data is also important for its portability.

User Acquisition Platforms such as Bidalgo, for example, integrate with AppsFlyer via its campaign management integration to enrich their analysis and automation capabilities.

Data processing capacity is also of the utmost importance when a company decides to implement a multi-channel User Acquisition strategy.

Even with a BI system in place, importing all of the data and processing it in a way that’s conducive to truly actionable insights will require a very significant investment.

How can you scale creativity?

Ad creative, together with bidding and audiences, are the main ingredients in every UA recipe. The latter two are very numbers-oriented, and easily digestible by algorithms.

As a result, they were the first to be impacted by the shift to a more automated campaign management. Every step taken in that direction had the added benefit of removing friction from UA workflows, and opening up the market to new players.

Ad creative, on the other hand, is still the purview of human marketers.

Working in tandem with designers, they have to translate creative endeavors into concrete numbers and KPIs. Without understanding what makes a creative asset successful, it isn’t easy to replicate that success. And even with the winning formula in hand, creative production is a labor-intensive process.

Within Bidalgo, Creative Management encompasses the entire lifecycle of an ad – from production to eventual fatigue.

Here, the ability to analyze data from multiple sources comes in handy yet again for creative-centric analysis across campaigns and channels. And at every step, it’s the combination of data from the marketing channel with attribution data from a measurement platform like AppsFlyer that makes building a bridge between creativity and productivity possible.

Bidalgo features such as creative auto-production, which generates asset iterations at the click of a button, rely on having accurate data about the past performance of “parent” assets.

The ability to assign predictive creative rank to an asset before it had been tested wouldn’t have been possible without analyzing vast amounts of data to “understand” creative success. And in order to recognize the earliest signs of creative fatigue, UA managers need access to accurate, cross-campaign performance data of an asset over time.

Efficient management drives effective growth

We live in an age of audience fragmentation.

The meteoric rise of TikTok throughout 2019 and 2020 is just the latest example of an exciting upstart redefining what’s cool and where the users are.

So while a single-channel activity can still prove effective, a broader, multi-channel UA strategy generally leads to greater opportunities for efficiency, growth and diversification – especially if your audience is relatively narrow.

With each new marketing channel, a new layer of complexity is added to UA workflows.

This includes budgets, now split between different accounts on different platforms, as well as management and analysis flows. Moreover, most first party campaign management interfaces aren’t built with power users in mind, as their explicit purpose is to make online marketing accessible to all.

The most advanced tools are often hidden or obscured.

User Acquisition Platforms simplify this process and unify multi-channel campaign management under one roof. Not all platforms have the same set of features, but you’re likely to find some bulk action capabilities, streamlined campaign creation and replication, bulk analysis, and maybe automation.

Who needs a user acquisition platform?

Extolling the virtues of UA platforms is easy, but we must add some context: not every mobile marketing activity requires such a toolset. There are many marketers for whom first-party ads managers and a spreadsheet are more than enough.

If you’re not trying to scale your activity and are satisfied with your current return on marketing investment – there’s a good chance you’re not missing much.

It is when there’s a nagging sensation that current tools are inadequate, that a User Acquisition Platform can help.

Even then, it’s essential to try and understand where growth bottlenecks are, and whether they’re technological in nature. If they are, there’s probably a platform for that.

Advanced considerations: Designing your stack for growth

At this point, we’ve laid the foundations for building a mobile-first marketing tech stack, from goal setting to definitions and use cases across the top MarTech categories.

Perhaps you’ve been inspired by some of the new applications that can be activated from tools or features that you’re not using today.

But given the wealth of options available, you may still be wondering how to prioritize which new tools to consider adding to your stack, and in what order. After all, it’s rare to work at an organization with the resources to add multiple tools at once – even if you can justify the financial cost of doing so, a phased adoption plan may be more realistic when it comes to team resources for partner evaluation, integration and onboarding.

In this chapter, we’ll dive deeper into industry trends and questions to consider when designing your tech stack strategy for sustainable growth, including:

- Common adoption trends and stack examples across the mobile industry

- The trade-offs of using all-in-one vs. best-in-breed technologies

- How to determine whether to build or to buy a new stack solution

Tech stack adoption trends

Let’s start by returning to the central visual for MarTech tool positioning across your user funnel and product lifecycle, introduced in Chapter 1:

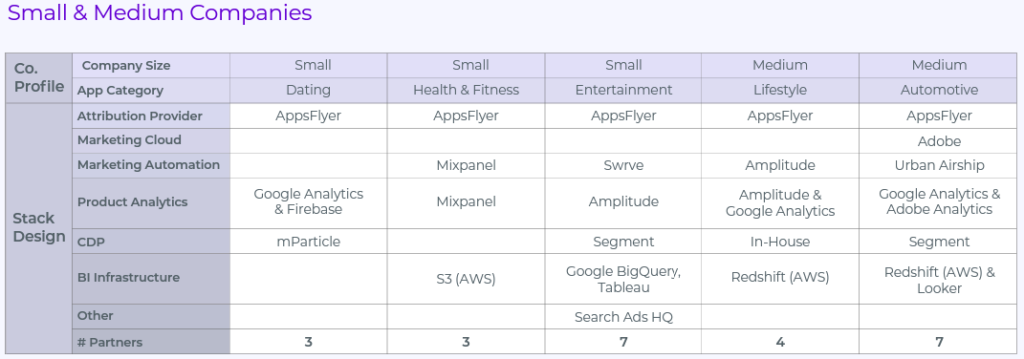

If you recall, we mentioned that most mobile-first companies tend to start with a free product analytics tool before advancing to more robust, paid product analytics suites provided by mobile-first leaders like Mixpanel and Amplitude.

For those entering the app space from established web-first enterprises, you might already be leveraging product analytics and customer engagement tools through your marketing cloud provider.

Regardless for web-first and mobile-first companies alike, the next paid solutions that will be mission-critical for your app’s success are attribution and marketing automation. The reason for this is that you cannot successfully orchestrate app lifecycle marketing without effective tools for customer engagement, deep linking and attribution from your paid and owned campaigns.

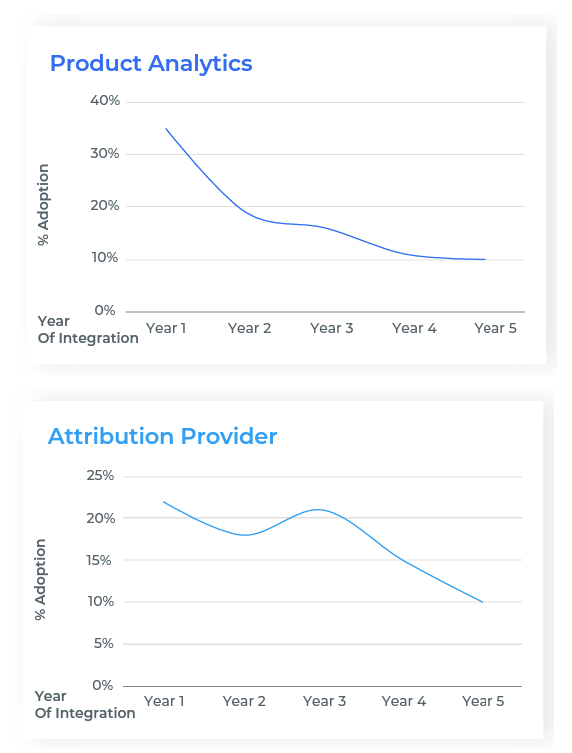

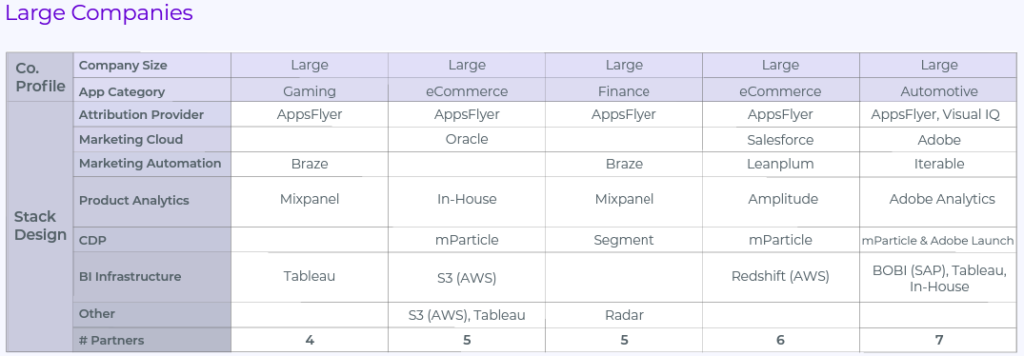

To see if the logic from this argument holds true, we analyzed Mighty Signal data on SDK adoption across 650 AppsFlyer clients.

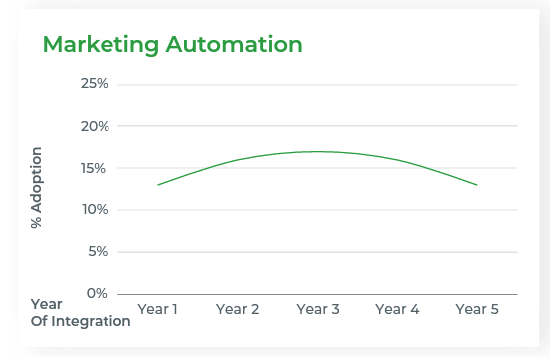

The following graphs validate our hypotheses, illustrating the proportion of apps that integrated specific types of MarTech tools over time.

Early adoption

Product analytics (35%) and attribution (22%) are the top two tools integrated in the first year.

As most apps integrate these mission-critical tools early on, adoption rates decrease over time.

Mid stage adoption

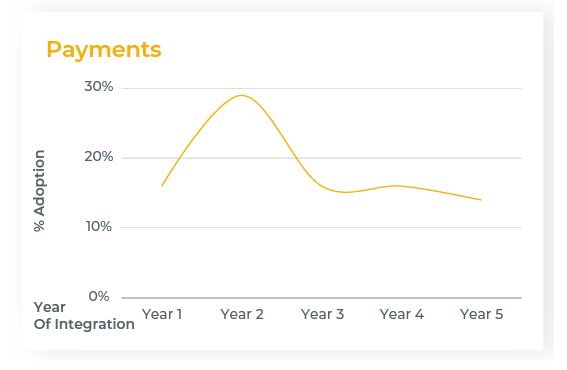

Payments (16%), marketing automation (13%) and marketing cloud (11%) are less likely to be integrated in the first year.

We see a bell curve trend for all three, with adoption rates peaking in years 2-3.

Mid-to-late stage adoption

CDPs (7%) and location services (0%) are the least likely to be integrated in the first year.

These tools are generally found in larger stacks, with adoption peaking in years 3-4.

As you can see, within the first year, 35% of apps use product analytics and 22% use attribution.

It’s important to note that while product analytics is the clear leader for first-year adoption, the vast majority of this category is represented by free tools.

As integration of both product analytics and attribution goes down over time, late stage adoption is often a sign of partner migration – and in the case of product analytics, that means advancing from free to paid partner solutions.

Interestingly, although we’ve emphasized the importance of integrating both attribution and marketing automation early on, attribution is far more likely to be adopted first (22% vs. 13% in year one, respectively).

This might be because web-first companies are able to orchestrate customer engagement with existing product analytics and marketing cloud tools at the outset, before recognizing the need for more advanced, mobile-first solutions provided by best-in-breed marketing automation tools.

On the other hand, for the reasons stated in Chapter 2, it would be unrealistic to scale mobile UA and deep link implementation without a dedicated mobile attribution provider. No other MarTech category offers parity solutions.

In year two, we start to see more advanced tools rise to the top, with 21% adopting a CDP and 29% adopting a tool for payments, such as Amazon, Braintree, Paypal or Stripe. As mentioned previously, CDPs become more valuable when they are used as the switchboard for more tools.

For example, let’s say you already have attribution and marketing automation, and you’re considering adding product analytics, payments, and location services tools within the next year—in this case, it would be wise to add a CDP before you go through the pains of manual integration for the next three tools.

In addition to facilitating real-time data transfer between stack tools, CDPs also make it far easier to update in-app event mapping to each tool as you continuously iterate on product design.

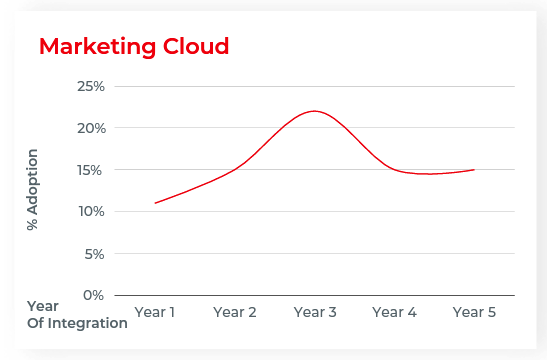

Marketing clouds follow a similar trendline to CDPs, as adoption doubles from 11% in year one to 22% in year three. Generally speaking, marketing cloud solutions are far more valuable for clients managing web-to-app flows and/or analyzing data across multiple apps than those focusing on one app alone.

Therefore, it’s likely that most of those using marketing cloud in year one were more established enterprises who already had other products or websites in market prior to adding a new app. Likewise, the addition of marketing cloud technology in later years is more typical of start-ups who expanded from one app to additional apps and/or platforms.

Given the significance of the marketing cloud as an enterprise solution, we’d be remiss to ignore the question: Where do marketing clouds fit within your strategy?

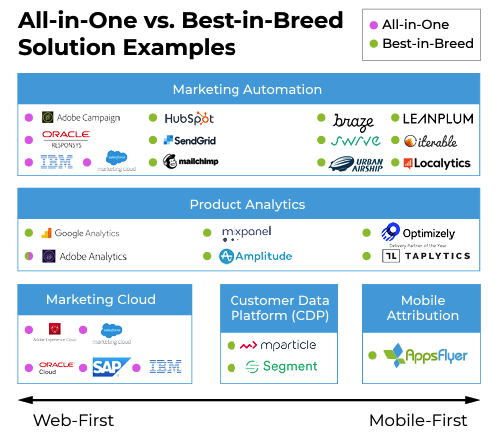

Strategic trade-offs: Best-in-breed vs. all-in-one

Thus far we’ve focused primarily on best-in-breed tools, which can be broadly defined as innovative products that specialize in a specific category or use case.

Generally speaking, there are two common types of tech stacks that we see across the marketing industry:

Best-in-breed

Mobile-first teams tend to seek point solutions for each MarTech category. We call this “best-in-breed” because savvy marketers are constantly reevaluating each MarTech solution to ensure they have the best version of that product.

They then work with a CDP or their engineering team to update SDKs as needed to ensure consistent integrations between Stack Components.

Not surprisingly, best-in-breed technology for mobile marketing tends to come from mobile-first providers, such as AppsFlyer or Braze, although there are some exceptions – for example, the product analytics category started by specializing in web analytics, and over time, companies like Amplitude, Mixpanel and Adobe expanded to support mobile.

All-in-one

As mentioned, the all-in-one solution tends to be more common for web-first companies with large enterprise teams. Although the term “all-in-one” can technically apply to any product that spans multiple MarTech categories, the term is epitomized by marketing cloud providers like Adobe, Oracle, Salesforce and IBM.

Because these “all-in-one” products tick so many boxes, some marketers find it easier to consolidate the majority of their marketing operations within a single marketing cloud solution.

As Gartner describes, these “platforms are typically anchored by a CRM or other large customer data system” and while they do “offer native mobile marketing capabilities, [they] also partner with third parties to support capabilities around delivery, monetization and measurement.”

Marketing clouds generally have more advanced capabilities for web than mobile, and may not be as nimble as smaller, mobile-first companies when it comes to product evolution and innovation.

For both of these reasons, mobile marketers often seek “best-in-breed” solutions to fill in gaps that cannot be fully solved by the “all-in-one” provider.

Eric Camulli, VP of Virtual Hold Technology, has an interesting take on the strategic tradeoff between the two models:

“There is something to be said for the Swiss Army knife.

It’s a great little tool that can help you in a jam. But if you’re not in a time-sensitive predicament and you have the opportunity to plan, then it’s better to be prepared with a full size set of tools so that you can perform the task at hand thoroughly and with precision and accuracy.

Indeed, there will always be a market for Swiss Army knives. Consumers will find the use of the all-in-one tool convenient and suitable to satisfy their basic requirements. However, many consumers have complex requirements that occur with greater frequency.

In these cases, modifiability and flexibility are the quality attributes prioritized ahead of convenience. These are the tasks that cannot be performed without a full size set of tools.

The same is true with technology.

Many all-in-one solutions, with the good intention of providing better value, fail to satisfy large segments of consumers who require greater quality and flexibility attributes.”