Funding strategies for app growth

Welcome to the twenty fourth edition of MAMA Boards, an AppsFlyer video project featuring leading mobile marketing experts on camera.

For today’s mini whiteboard master class, we have Siberia Su, Director of Marketing at Braavo Capital, a category-defining funding platform that provides on-demand funding for mobile apps.

Behind every great app is the capital fuelling its growth. However, many marketers, especially in earlier growth stages, find fundraising challenging, often because they don’t know the options available. To bridge this knowledge gap, Siberia introduces us to the main types of funding available at every growth stage, shows their pros and cons, and later gives two powerful tips to maximize their benefits.

Real experts, real growth. That’s our motto.

Enjoy!

Transcription

Hi everyone. Welcome to another episode of MAMA Boards by AppsFlyer. My name is Siberia Su, and I’m a Director of Marketing for Braavo, a category-defining funding platform that provides on-demand funding for mobile apps. Today, we’re going to talk about funding strategies for app growth.

What is mobile funding?

Firstly, let’s look at what is fundraising. In the history of humanity, nobody ever said, “I love fundraising”… because it’s not easy. Basically, you’re asking people for money to execute on your vision.

Whether you are a founder or a marketer, you need to be able to tell a story about how you need to use the money to achieve a desired goal.

What are the challenges of mobile fundraising?

Now, let’s look at the challenges of fundraising.

Firstly, it is very time-consuming. It takes energy and time away from entrepreneurs to really focus on their day-to-day business.

Secondly, as mobile entrepreneurs, you may lose control of your business when you raise venture capital.

Third, a lot of founders are actually not familiar with all the funding options they have. They think they may only have two options: bootstrapping, meaning funding from your own money, or raising venture capital. If you are an app entrepreneur that is trying to build a unicorn from conception to massive success, we are assuming that you’re not going to bootstrap your business throughout its lifetime.

What types of funding for apps are available at different growth stages?

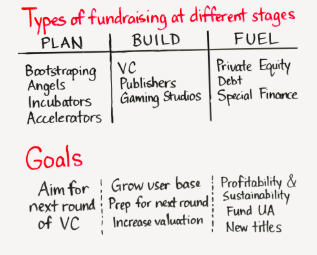

So, let’s take a look at different types of funding available at different stages.

At the earliest stage, what we call the planning stage, the main business goal here is to set up for the next round of funding by building your MVP product, evaluating market opportunities, and building your core team. The funding options that you have during this stage including bootstrapping, monies from family and friends, angel investors, and incubators and accelerators. Note that, with incubators and accelerators, they typically don’t provide much capital, but what they can do is to provide you with relevant education, mentoring, and growth strategies to help you scale your business for the long term.

If your business does okay in the planning stage, you slowly move on to the build stage. In the build stage, the goal of your business is to start growing your user base. You also start to assemble your core team, expand the team size, and prepare for the next round of funding – broadly speaking, you’re trying to increase the valuation of your company. At this stage, venture capitals, or VCs, usually play a pretty big role in hopes of getting a much higher return and exit down the road from your business. Essentially, you’re selling a piece of your business based on an evaluation of a much higher multiple down the road in exchange for the money that you will be getting.

If you are a gaming app, some of the larger gaming studios and publishers may step in at this stage. If your business has demonstrated a profitable growth trajectory, they may start to acquire you or take a stake in your business as an investment.

Additionally, if your early metrics look strong, at this, specialty financing may also step in to give you options for increasing the liquidity of your business and expanding your capital runway. Specialty finance usually comes in the form of cohort-based financing, performance-based financing, or future account receivable based financing based on the actual performance of your business.

If everything goes well – your business begins to scale, demonstrates long-term profitability, and starts to generate large sums of revenue – you move on to the third stage, what we call fuelling the rocket ship. This is where you really want to take your business into unicorn status.

At this stage, you’re aiming for the long-term profitability and the sustainability for your business. You need to raise capital to fund your user acquisition or investment in new titles to expand the long-term revenue potential for your business. This is also where you need to look for venture partners, like private equity, or sometimes large sums of non-dilutive bank debt that can continuously invest in your business and scale for a long-term growth.

The bottom line is that, when it comes to fundraising, it is really about finding the right tool for the right moment of growing your business.

How do I choose the right funding tool for my app?

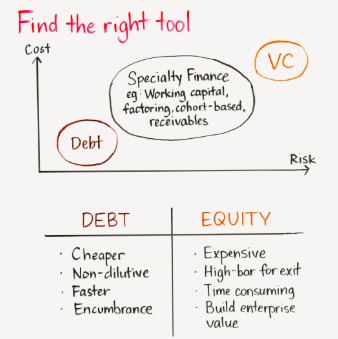

To visualize this, let’s look at this chart. VCs, as we all know, are usually on the higher end of both risk and cost. They usually come in at a relatively early stage in hopes of getting a much higher return down the road of your business.

On the other side, bank debt is usually both lower cost and lower risk. However, the entry bar of getting bank financing is relatively higher because, as a business, you need to have proven profitability to qualify to receive a bank loan and later have to show your organizational maturity and sustainability.

Somewhere in between, specialty financing also has relatively lower cost and risk. However, the entry bar of specialty financing is higher than VC as well in the sense that you would have to prove your ability to generate revenue as a business in order to be qualified. As mentioned before, the types of specialty financing available include factory financing, cohort-based financing, and future receivable based financing. Most are based on the performance of your business.

What are the pros and cons of common fundraising solutions (debt and equality)?

Now, let’s look at the pros and cons of debt and equity to most discussed types of fundraising solutions.

With debt, it is cheaper and faster to raise. It is a type of non-dilutive fundraising option that doesn’t require selling a piece of your business. The downside of debt are the encumbrances, such as liens and performance covenants, that usually require you to repay over an extended period of time. If you’re not generating regular revenue and your business expenses are high, that can be a problem.

Now, let’s look at equity. Equity is expensive to raise and it is very time-consuming. It takes your attention away from operating and focusing on the business. It also has a higher exit bar depending on the return that your investors want. However, equity does help you build your enterprise value and if you’re really looking to build a unicorn type of startup, you would have to raise equities for your business. It is very hard to source strategic, cheaper capital if you’re really looking to build a massive successful startup.

How does mobile funding impact user acquisition?

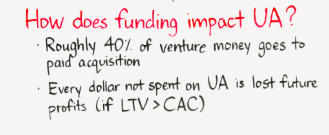

Now, let’s look at how funding impact economics of user acquisition. There’s a quote from the CEO of Social Capital who once said, “Roughly 40 percent of venture dollars goes to paid acquisition.” That is a lot of dilutive capital that goes into the day-to-day business operation. What if you can replace this with something that you have control over, like Braavo?

The second quote I have is from the founder of Verv, a top-grossing fitness app. She said, “Every dollar not spent on user acquisition is lost future profits if the average lifetime value of users is larger than your customer acquisition cost.” You are basically leaving money on the table to not max out your user acquisition potential because you are not getting the maximum potential of your future cash flow.

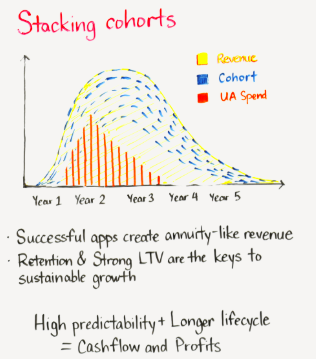

Now, let’s look at this chart, featuring stacking cohorts. This chart explains the rationale behind why not spending hard on UA early on is going to make you lose future profits.

Let’s take Gaming apps as an example. Whether you are a casual, midcore, or hardcore game, there’s usually a payback window of 3 to 12 months, to even longer, for you to get the money back from your user acquisition dollar spend.

As you can see in this blue chart, there is the long tail of the revenue that you generated from your early UA spend to acquire these cohorts. Based on these trends, the more you can spend at a profitable ROI early on for your future cash flow, the more you should be pushing. In this way, you don’t lose money on the table.

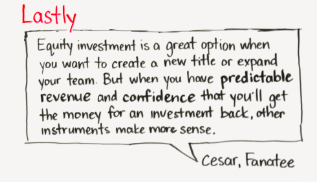

Lastly, let’s look at a quote from Cesar, co-founder of Fanatee, a top-grossing app and a client of Braavo’s. He said, “Equity investment is a great option when you want to create a new title or expand your team. But when you have predictable revenue and confidence that you will get the money from investments back, other instruments make more sense.”

In other words, if you know that you have a profitable growth trajectory for your user, it may make more sense to explore some of the non-diluted funding solutions before you go out and raise another round of capital.

Bottom line

To summarize our talk, when it comes to fundraising, there are two important things.

First, it is important to remember the goal of your business operation before you go out and then decide a type of funding to pursue. Second, it is crucial to scale your user growth to full potential early on to max out your future cash flow and profitability.

That’s it for today. If you have any comments, please leave it in the sections below. If you have any questions around funding for mobile apps, please visit Braavo’s website. If you’re interested in watching more MAMA Boards, subscribe here.

Thank you.